Did Changing Sentiment Drive Oscar Properties Holding's (STO:OP) Share Price Down A Painful 87%?

While it may not be enough for some shareholders, we think it is good to see the Oscar Properties Holding AB (publ) (STO:OP) share price up 16% in a single quarter. But only the myopic could ignore the astounding decline over three years. In that time the share price has melted like a snowball in the desert, down 87%. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Oscar Properties Holding

Oscar Properties Holding isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Oscar Properties Holding saw its revenue grow by 2.4% per year, compound. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 49%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

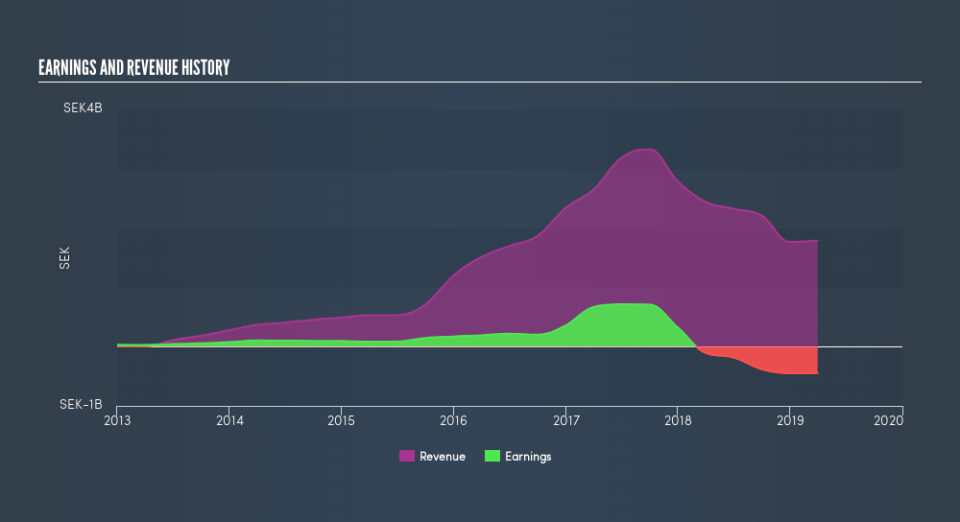

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Oscar Properties Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Oscar Properties Holding had a tough year, with a total loss of 71%, against a market gain of about 1.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 24% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.