Did Changing Sentiment Drive Palash Securities's (NSE:PALASHSEC) Share Price Down By 23%?

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Palash Securities Limited (NSE:PALASHSEC) share price slid 23% over twelve months. That falls noticeably short of the market return of around -11%. Palash Securities may have better days ahead, of course; we've only looked at a one year period. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 8.4% in the same timeframe.

Check out our latest analysis for Palash Securities

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Palash Securities share price fell, it actually saw its earnings per share (EPS) improve by 8.0%. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

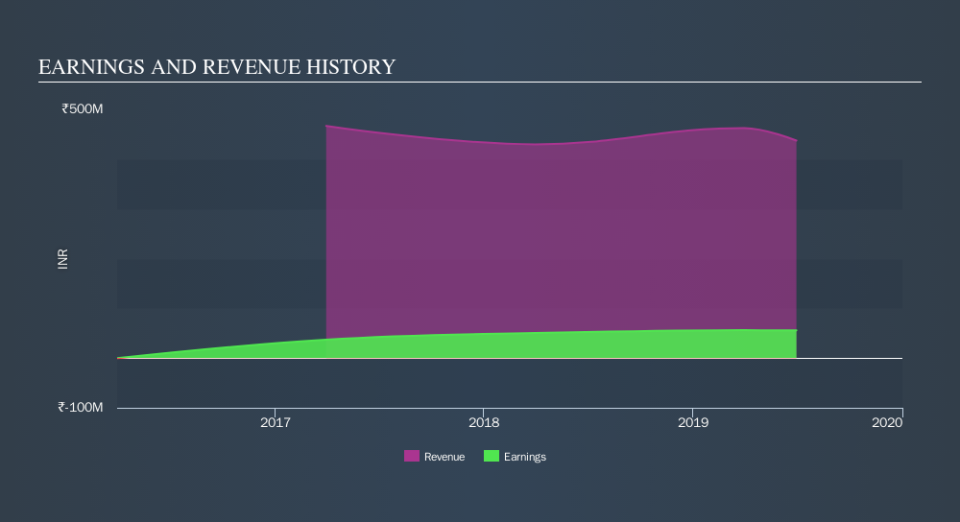

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Palash Securities's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Palash Securities shareholders are down 23% for the year, even worse than the market loss of 11%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 12% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Palash Securities you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.