Did Changing Sentiment Drive Wing Chi Holdings's (HKG:6080) Share Price Down By 11%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's normal to be annoyed when stock you own has a declining share price. But often it is not a reflection of the fundamental business performance. The Wing Chi Holdings Limited (HKG:6080) share price is down 11% in the last year. However, that's better than the market's overall return of -13%. We wouldn't rush to judgement on Wing Chi Holdings because we don't have a long term history to look at. Unhappily, the share price slid 4.8% in the last week.

View our latest analysis for Wing Chi Holdings

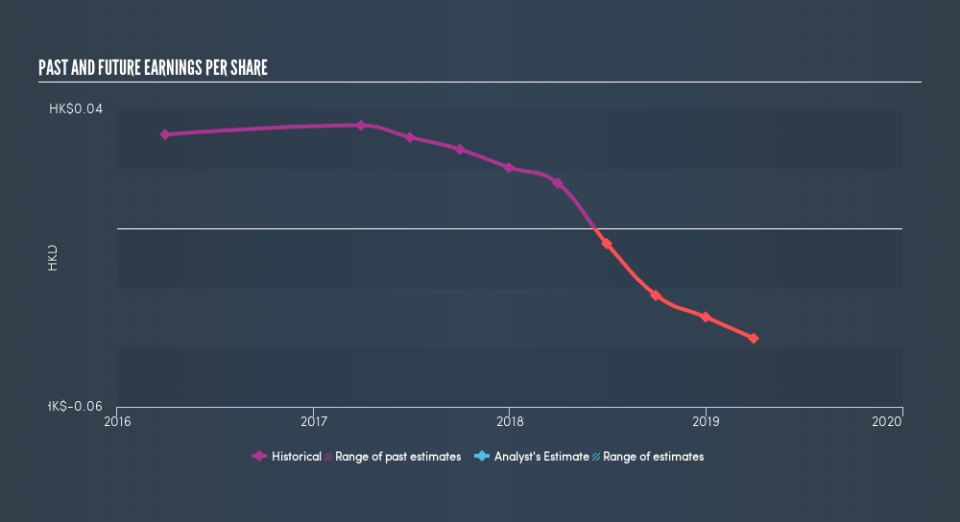

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Wing Chi Holdings fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Wing Chi Holdings's earnings, revenue and cash flow.

A Different Perspective

It's not great that Wing Chi Holdings shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 11% wasn't as bad as the broader market loss of about 13%. Unfortunately for shareholders, the share price momentum hasn't improved much with the stock down 3.3% in around 90 days. This doesn't look great to us, but it is possible that the market is over-reacting to prior disappointment. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Wing Chi Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.