Did Jay Mazini pull off the 'biggest Ponzi scheme in any Muslim community in the US?'

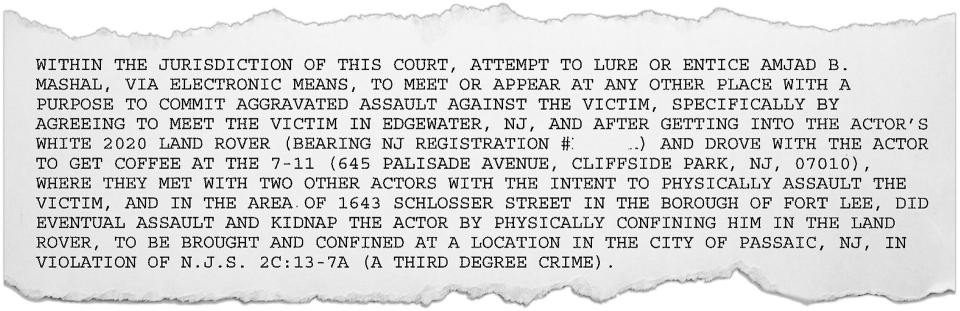

Amjad Mashal sat in a white Range Rover, his mind racing. Two men with hoods up and medical masks covering their faces had just burst into the back seat of the vehicle while it was parked at a 7-Eleven in Cliffside Park, New Jersey.

Jay Mazini — the social media influencer who found fame after videos of him giving away thousands of dollars alongside rap icons went viral — was irate. He thought Mashal owned an Instagram page called the Mazini "official scam page" that trashed Mazini with videos and comments.

Mazini demanded Mashal's phone. He wanted access to the page.

Mazini drove away from the store, heading north on Palisade Avenue. When they stopped at a red light at Main and Schlosser streets in nearby Fort Lee, Mashal took a risk.

He jumped out and started running. Sprinting down an alley, he had no idea just how bad things would get.

That cold, dark night in March, 2021 was a far cry from the idyllic video Mazini posted from the Middle East in 2018.

In it, Mazini glided past the arched doorways and towering minarets of the Great Mosque of Mecca, considered the holiest site in the Islamic faith, his head wrapped in a turban and his camera rolling in selfie mode.

Praying at the mosque where the Prophet Muhammad once prayed is the “greatest feeling ever,” he told his nearly million followers on Instagram and YouTube.

“Sometimes you got to realize there’s more to life than materialistic things — cars, fashion, jewelry. You got to find yourself within life, nature, religion," he said. "You’ll go broke looking for yourself in these kinds of things. Yes, I achieved a lot of goals within my life, but I still felt like I was missing something. I was missing God. I was missing religion.”

“I respect all religions,” he said. “Find yourself within faith, within spirit, spiritual faith, within religion. That’s where you’ll find real happiness.”

For about five years, Mazini doled out spiritual advice, knelt in prayer and made pilgrimages to Mecca in scenes captured in social media videos that racked up online views, shared by celebrities — including Snoop Dogg — and posted on the Instagram platform for WorldstarHipHop with 40 million followers.

For Mazini, whose real name is Jebara Igbara, spirituality was part of a public persona that blended luxury living, business savvy and big cash giveaways.

His Instagram followers were inspired by his faith, financial success and generosity. But detractors, and later law enforcement, charged that Mazini used religion to gain trust and perpetrate fraud that cost investors millions.

“A Muslim boy doing bitcoin investing, doing umrah [pilgrimage] and praying, saying he doesn’t drink, smoke, and is a virgin. He was using Islam to blind them — using his faith and purity to gain trust and all that,” said Feras Awwad, who grew up in the same tight-knit community in Clifton, New Jersey, as Mazini.

In North Jersey, Mazini found investors eager to support an entrepreneur from their community whom they saw as a role model for a younger generation. But others were skeptical of his claims of financial wisdom and spiritual depth.

Some felt that his flaunting wealth was a contradiction of Islamic values. At worst, they feared he was using religion to lure people into a host of schemes disguised as business opportunities.

“There were women from the same village [as his family], his own family and friends, who believed he was a financial guru,” said a family friend from Paterson. “How do you trust a 21-year-old with no experience, no college degree?”

Among his most vociferous critics was Amjad Mashal of Wayne, who mocked Mazini in online videos.

“Stop lying to people. Stop acting shady online,” he said in a video that he paid to post on the Worldstar page. “Stop putting up this front that you’re some prophet or godly public figure.”

Jay Mazini scam targets Muslims: Investing ‘halal’

After years of hustling to sell products on Bronx streets, Mazini started an electronics sales company in 2015 and a clothing brand with rapper Dave East the following year. Then, in 2019, the rising entrepreneur launched the Mazini Academy, where students could learn stock trading.

Mazini's businesses were overlapping, and so were his schemes. He was known for promoting big giveaways for hard-to-get PS5 game consoles, cars and cash, but many customers said they did not get what was promised. Still, his Instagram followers grew to nearly a million as he posted videos giving away stacks of cash alongside famous hip-hop stars.

Mazini was climbing toward fame as he launched Halal Capital in late 2019, but in New Jersey, his reputation was flailing and his debts were growing. So when he sought new investors, he turned to a Muslim immigrant community in New York City and to Noor Rabah, a respected Muslim funeral home director, whom he recruited as a partner.

The next spring, Waleed Suleiman, a cellphone salesman from Staten Island, got a call from his cousin telling him about a business opportunity through Rabah, whom they knew from Masjid Al-Ansar, a mosque in Brooklyn.

Rabah was leading a company that would invest in products that are “halal,” meaning they are permissible in Islam. They avoid “haram” products like alcohol, tobacco or pork, and don’t conduct business that involves charging interest.

“Times are hard. If you are interested, let me know,” Suleiman’s cousin told him, adding that he had already seen a profit since investing in January.

In May, Rabah visited Suleiman at his home to pitch the investment to him and his cousin, uncle and brother. With them gathered in the backyard, Rabah told them the company was buying and reselling medical supplies and hand sanitizers, which were in demand during the COVID pandemic.

According to interviews and court documents, Rabah was making similar pitches to Muslims at their homes and mosques, telling people that together they could build wealth, raise up their community and help their families — and that God wanted them to be successful. He offered high rates of return and low risk. From October 2019 to May 2020, Rabah collected millions of dollars from them, mostly in cash payments.

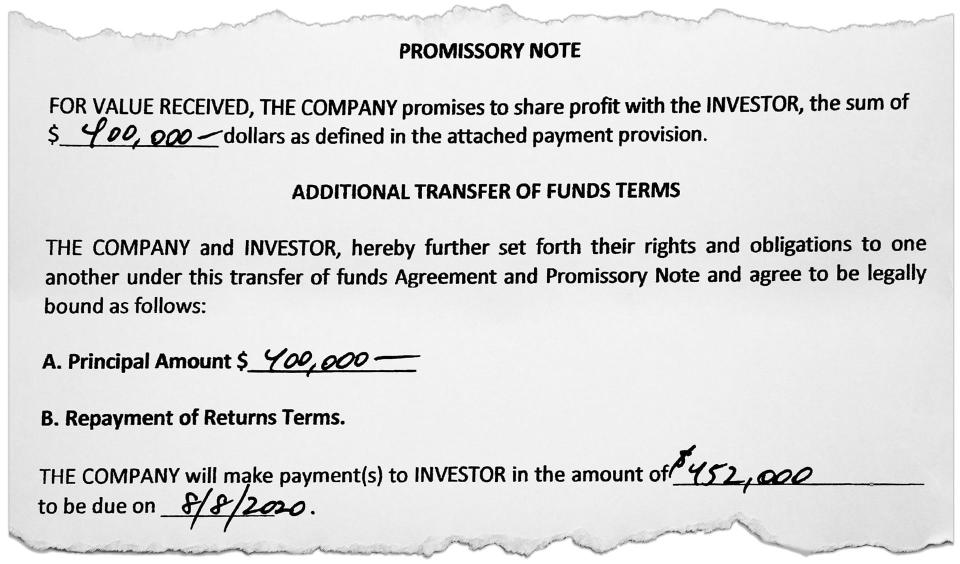

Suleiman put in $100,000. So did his family members. Rabah signed promissory notes that they believed guaranteed repayment. By August, they got back $10,000, which Rabah said was profit. He urged them to put the money toward a new opportunity selling glass. They did, Suleiman said, and then they stopped seeing returns.

Rabah never mentioned that Mazini was a partner in the company until things started to fall apart, he said.

“One hundred percent, I would not have invested if I knew,” said Suleiman, who viewed Mazini as a “fast talker” who acted “like a big shot.”

Suleiman hoped to use his savings and earnings for his children’s college tuition. Now, he desperately wants to know where Mazini stashed the money people sent him and Rabah, hoping he can get restitution in court.

He is among seven people, along with the mosque, who sued Mazini and Rabah in a Brooklyn court in January. They invested amounts between $60,000 and $3.3 million, according to the lawsuit.

They say they are owed close to $5 million combined as well as attorney’s fees and damages.

Jay Mazini claims he was robbed — of $20 million

In an interview, Rabah said he told investors about Mazini’s involvement from the start. He denied that he knew of any scheme and said he was also a victim, having invested his money and family money.

“We’re all in the same boat,” Rabah said. “We all got screwed. We all got scammed.”

Rabah was giving a talk at a Staten Island mosque when he met Mazini in January 2019. Mazini was there delivering a motivational speech to a group of young people. Over many encounters, the two had “deep conversations” about building a mosque, helping the community and supporting Muslims struggling with addiction, Rabah said.

Rabah said more than 600 of Mazini’s followers recited Shahada — the Muslim declaration of faith used for converting — after asking questions about Islam. Rabah responded to them personally and connected them with mosques, he said. He felt they were doing good work by spreading faith and helping people build income.

But to investors, it seemed the funeral director, like his business partner, was exhibiting a newfound luxury lifestyle, driving a pricey Mercedes G-Wagon and sporting gold watches.

But months after they invested, Mazini started making excuses instead of paying people returns. Rabah was pressing his partner to get the money to pay people, who were growing anxious over the delays.

Traditionally in Palestine, where Mazini’s relatives — the Igbara family — have their roots, families and villages may be asked to account for the actions of their members. Investors visited the Igbara family in New Jersey demanding a resolution and pressing them to get the social media star to pay up.

Rabah said he believed Mazini until the day he made a stunning announcement. Mazini told him he could not pay people back because he had been robbed at gunpoint of more than $20 million in cash while driving alone, without his usual entourage.

“That’s when I just automatically lost faith, faith in who he was, the image he built up, when he said that,” Rabah said. “I was born and raised in Brooklyn, but when he said that I knew I got suckered.”

Rabah has filed his own lawsuit against Mazini and several family members and associates who he believes conspired in his schemes.

The lawsuits filed by Rabah and Halal Capital investors are still pending, but Mazini has already pleaded guilty to defrauding investors in a federal court in November. A judge will determine restitution at his sentencing, which has not been scheduled.

Halal Capital: ‘Biggest Ponzi scheme' in Muslim community

Investors have accused the Halal Capital partners of affinity fraud, a kind of scam that preys upon people in certain groups, especially religious and ethnic ones. The scammers are part of, or pretend to be, members of that group. They often enlist a community or religious leader who will build trust and spread the word without being aware any fraud is taking place.

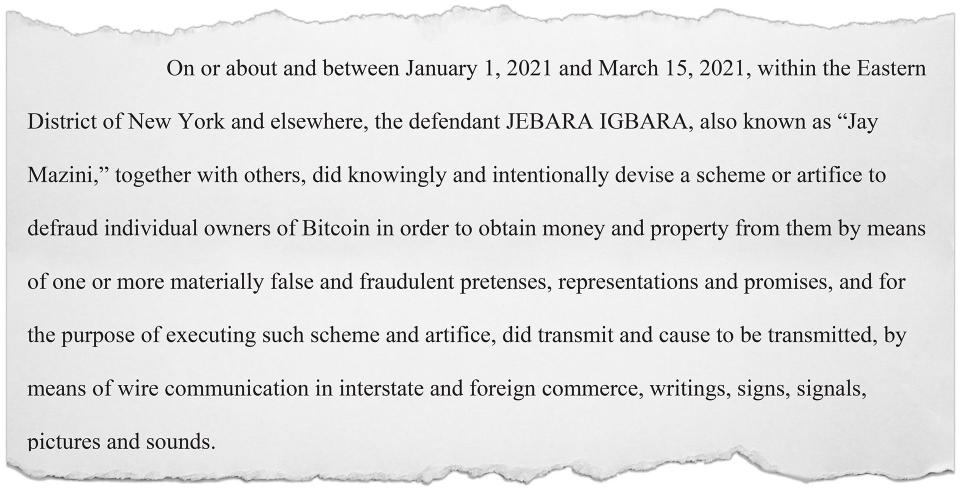

The number of people affected by Mazini’s Halal Capital scheme — to which he admitted in federal court on Nov. 2 — is not fully known.

The Securities and Exchange Commission identified more than a dozen Halal Capital victims who lost $8 million combined.

Four more people were robbed of $5 million in a bitcoin scheme, in which Mazini told online followers he would pay above market prices for bitcoin and then sent forged wire transfer confirmations instead of payment, he said in a court statement.

"None of the Halal Capital investors’ money was actually placed in any investment, let alone the purported Quran-compliant investments,” the SEC said in its complaint, calling it a Ponzi scheme.

There are more victims who have not come forward or filed complaints. In New York City, a prominent Muslim community leader said he personally knew about 20 people who lost money with Halal Capital.

He knew green card holders and undocumented immigrants from countries including Pakistan, Uzbekistan and Egypt who were afraid to complain to authorities. Others were embarrassed to admit their involvement or did not want to bring negative attention to the Muslim community, said the leader, who lives in Brooklyn and did not want to provide his name because of legal threats he received from Rabah’s attorney.

The local leader said he believed that this was “the biggest Ponzi scheme that happened in any Muslim community in the U.S.”

A kidnapping escalates as a scam crumbles

The scheme was unraveling, and Mazini was prepared to do anything to prevent its collapse.

Mashal said he did not start the Instagram page that drew Mazini’s ire, but he did contribute to it with his own comments and videos.

He had wanted to get back at Mazini ever since the two had a falling out over business that became personal. Mashal told people Mazini didn’t pay him and that his persona was fake. Mazini spread rumors about Mashal's mental health and about his family.

“I wanted revenge for the way he had hurt me," Mashal said. "Not physically, but emotionally.

“It fueled the rage in me. This guy really thinks he’s above others and can talk about people like that … It was personal," Mashal said. "I don’t think people that lie or cheat, I don’t think they deserve to win or succeed.”

Threats and arguments escalated. But Mashal did not think he was in danger until that night, when he bolted out of Mazini’s vehicle. The two men gave chase as he ran across a street, down an alley and up a staircase. Trapped, he jumped from the second-floor balcony of a restaurant and tumbled to the ground.

In a scene captured by surveillance cameras and described by police, the men pummeled him repeatedly and forced him back into the Range Rover. They kept driving until they got to Passaic.

“I tried to call for help,” said Mashal. “But it was 3:30 at night and there was no one.”

This article originally appeared on USA TODAY: Jay Mazini 'halal' Ponzi scam netted millions from Muslims