Did You Manage To Avoid Ainsworth Game Technology's (ASX:AGI) Devastating 83% Share Price Drop?

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Anyone who held Ainsworth Game Technology Limited (ASX:AGI) for five years would be nursing their metaphorical wounds since the share price dropped 83% in that time. And some of the more recent buyers are probably worried, too, with the stock falling 46% in the last year. Furthermore, it's down 42% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 23% in the same timeframe.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Ainsworth Game Technology

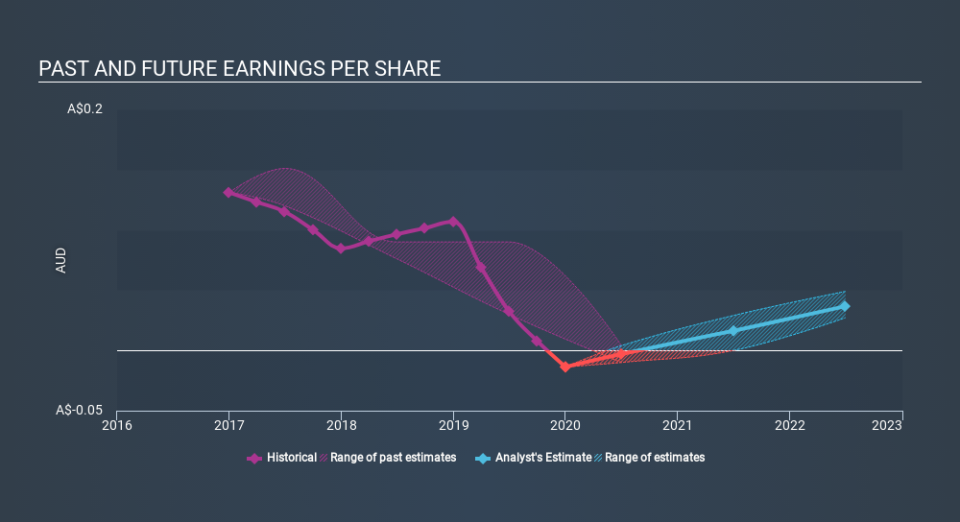

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over five years Ainsworth Game Technology's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Ainsworth Game Technology's key metrics by checking this interactive graph of Ainsworth Game Technology's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Ainsworth Game Technology shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 10%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 29% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Ainsworth Game Technology .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.