Did You Manage To Avoid China State Construction Development Holdings's (HKG:830) 40% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in China State Construction Development Holdings Limited (HKG:830), since the last five years saw the share price fall 40%. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 7.9% in the same period.

View our latest analysis for China State Construction Development Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, China State Construction Development Holdings actually saw its earnings per share (EPS) improve by 24% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past. Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

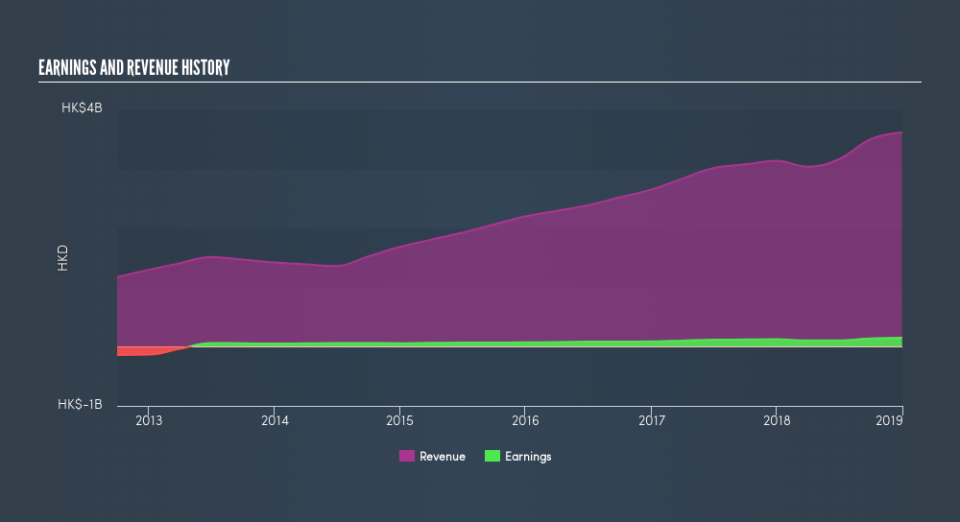

In contrast to the share price, revenue has actually increased by 19% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of China State Construction Development Holdings, it has a TSR of -35% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that China State Construction Development Holdings has rewarded shareholders with a total shareholder return of 27% in the last twelve months. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 8.2% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.