Did You Manage To Avoid CK Hutchison Holdings's (HKG:1) 50% Share Price Drop?

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term CK Hutchison Holdings Limited (HKG:1) shareholders for doubting their decision to hold, with the stock down 50% over a half decade. The silver lining is that the stock is up 4.1% in about a week.

See our latest analysis for CK Hutchison Holdings

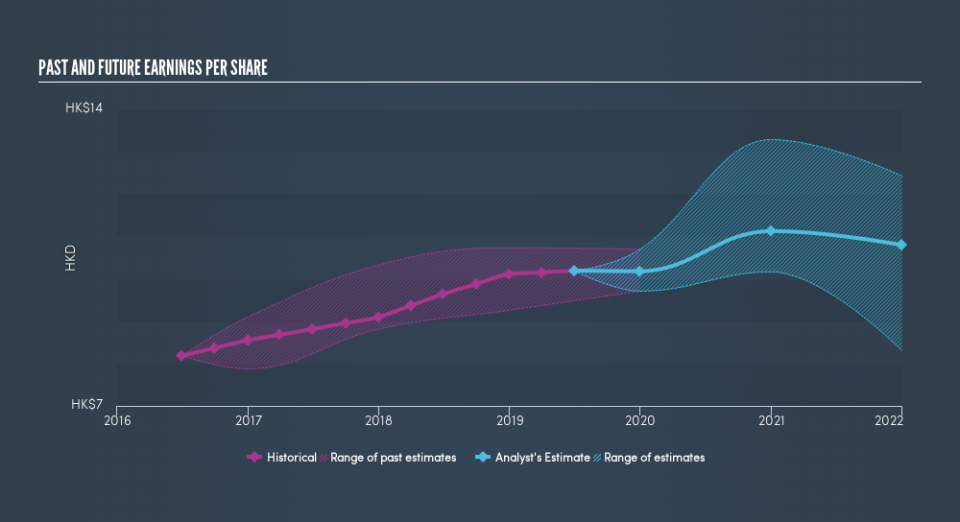

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, CK Hutchison Holdings's earnings per share (EPS) dropped by 7.7% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 6.93 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on CK Hutchison Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, CK Hutchison Holdings's TSR for the last 5 years was 0.6%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 7.3% in the twelve months, CK Hutchison Holdings shareholders did even worse, losing 16% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 0.1%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of CK Hutchison Holdings by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.