Did You Manage To Avoid COSCO SHIPPING Holdings' (HKG:1919) Painful 65% Share Price Drop?

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. To wit, the COSCO SHIPPING Holdings Co., Ltd. (HKG:1919) share price managed to fall 65% over five long years. We certainly feel for shareholders who bought near the top. And it's not just long term holders hurting, because the stock is down 33% in the last year. Shareholders have had an even rougher run lately, with the share price down 26% in the last 90 days.

See our latest analysis for COSCO SHIPPING Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

COSCO SHIPPING Holdings became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

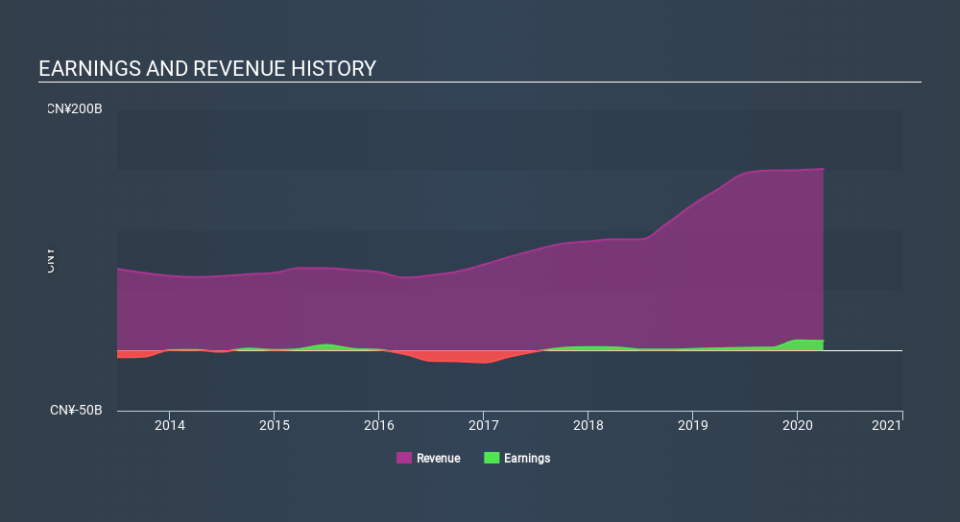

Revenue is actually up 21% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on COSCO SHIPPING Holdings

A Different Perspective

We regret to report that COSCO SHIPPING Holdings shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 6.9%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 19% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand COSCO SHIPPING Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with COSCO SHIPPING Holdings (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.