Did You Manage To Avoid Feiyu Technology International’s (HKG:1022) Devastating 84% Share Price Drop?

Feiyu Technology International Company Ltd. (HKG:1022) shareholders should be happy to see the share price up 27% in the last quarter. But only the myopic could ignore the astounding decline over three years. The share price has sunk like a leaky ship, down 84% in that time. So we’re relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

View our latest analysis for Feiyu Technology International

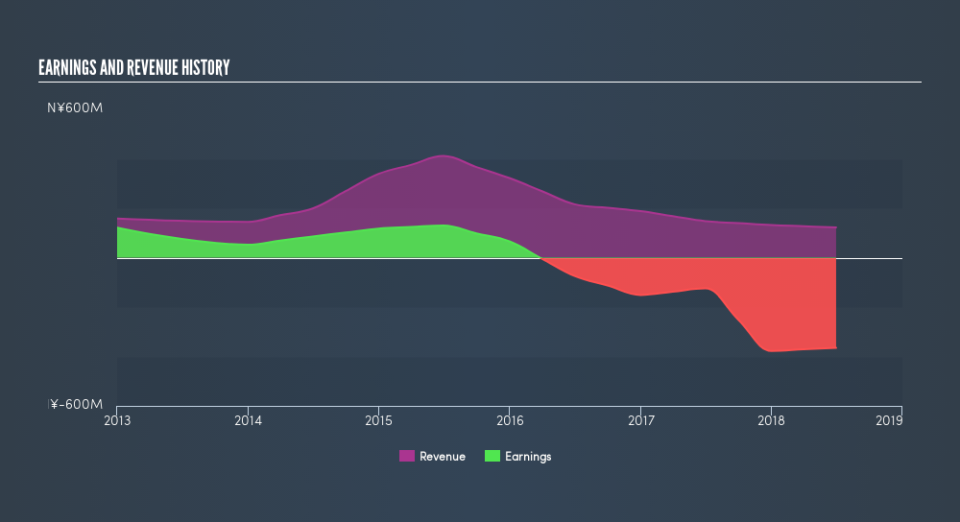

Because Feiyu Technology International is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years Feiyu Technology International saw its revenue shrink by 43% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 46% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. There is a good reason that investors often describe buying a sharply falling stock price as ‘trying to catch a falling knife’. Think about it.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Feiyu Technology International shareholders are down 52% for the year, falling short of the market return. Meanwhile, the broader market slid about 6.6%, likely weighing on the stock. The three-year loss of 45% per year isn’t as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Feiyu Technology International by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.