Did You Manage To Avoid Harris Technology Group's (ASX:HT8) 48% Share Price Drop?

It is doubtless a positive to see that the Harris Technology Group Limited (ASX:HT8) share price has gained some 240% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 48% in the last three years, falling well short of the market return.

Check out our latest analysis for Harris Technology Group

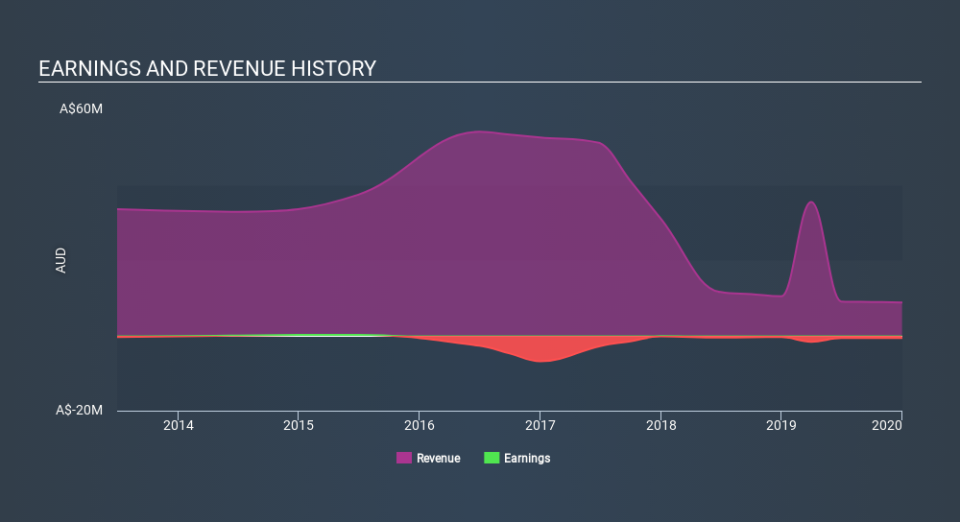

Because Harris Technology Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Harris Technology Group's revenue dropped 62% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 20% per year is hardly undeserved. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Harris Technology Group's earnings, revenue and cash flow.

A Different Perspective

Pleasingly, Harris Technology Group's total shareholder return last year was 3.0%. That certainly beats the loss of about 20% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Harris Technology Group (of which 1 can't be ignored!) you should know about.

Of course Harris Technology Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.