Did You Manage To Avoid Inke's (HKG:3700) 30% Share Price Drop?

Inke Limited (HKG:3700) shareholders should be happy to see the share price up 19% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 30% in a year, falling short of the returns you could get by investing in an index fund.

View our latest analysis for Inke

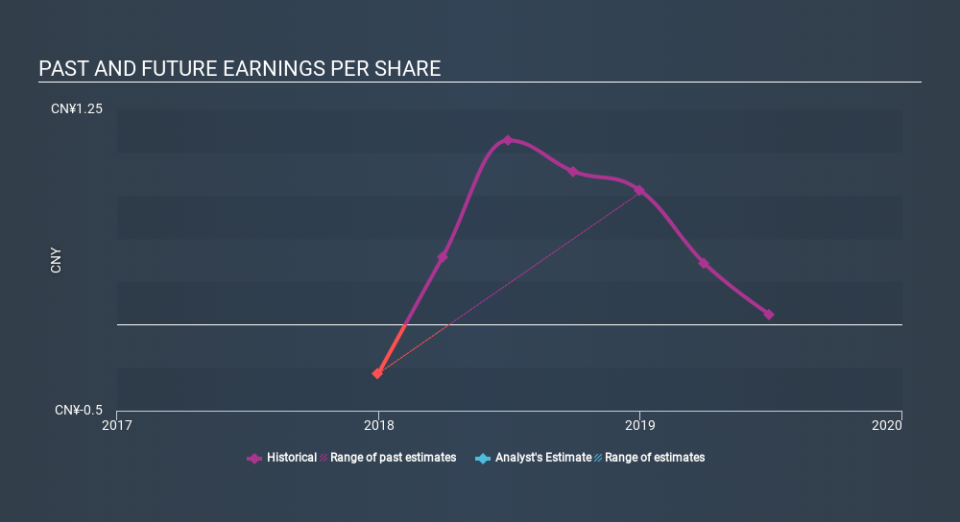

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Inke reported an EPS drop of 95% for the last year. This fall in the EPS is significantly worse than the 30% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Inke's key metrics by checking this interactive graph of Inke's earnings, revenue and cash flow.

A Different Perspective

While Inke shareholders are down 30% for the year, the market itself is up 3.2%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 17% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Inke (including 1 which is is potentially serious) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.