Did You Manage To Avoid Orchard Funding Group's (LON:ORCH) 23% Share Price Drop?

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Orchard Funding Group plc (LON:ORCH) share price is down 23% in the last year. That falls noticeably short of the market return of around 3.6%. However, the longer term returns haven't been so bad, with the stock down 17% in the last three years. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

View our latest analysis for Orchard Funding Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Orchard Funding Group share price fell, it actually saw its earnings per share (EPS) improve by 11%. Of course, the situation might betray previous over-optimism about growth. The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

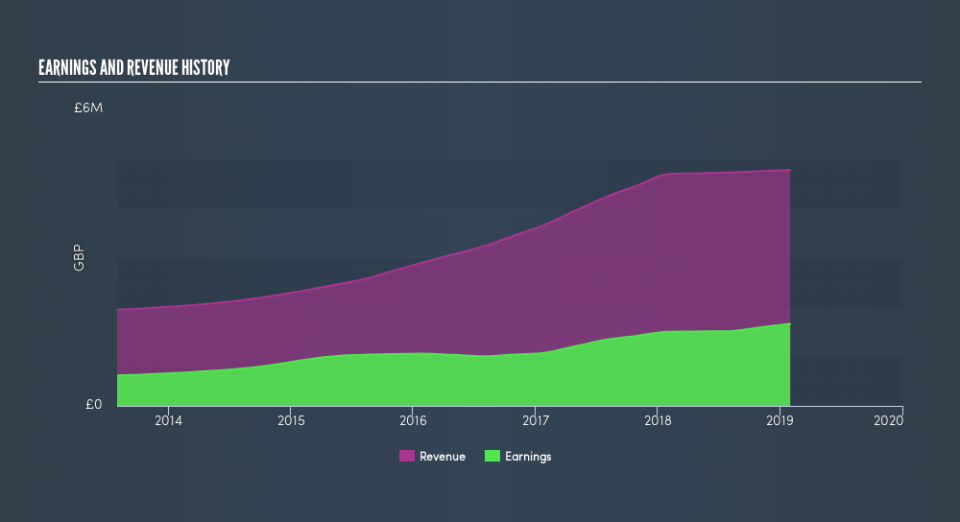

Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Orchard Funding Group has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Orchard Funding Group stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Orchard Funding Group's TSR for the last year was -20%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for Orchard Funding Group shares, which cost holders 20%, including dividends, while the market was up about 3.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 3.3% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Before forming an opinion on Orchard Funding Group you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.