Did You Manage To Avoid Peyto Exploration & Development's (TSE:PEY) Devastating 83% Share Price Drop?

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Anyone who held Peyto Exploration & Development Corp. (TSE:PEY) for five years would be nursing their metaphorical wounds since the share price dropped 83% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 39% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Peyto Exploration & Development

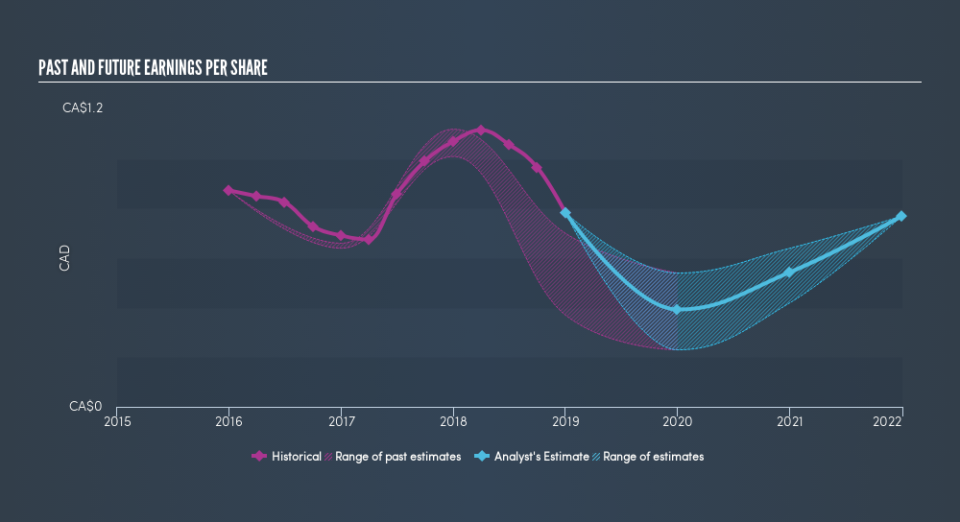

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Looking back five years, both Peyto Exploration & Development's share price and EPS declined; the latter at a rate of 4.0% per year. This reduction in EPS is less than the 30% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 8.59.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Peyto Exploration & Development's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Peyto Exploration & Development the TSR over the last 5 years was -78%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Peyto Exploration & Development shareholders are down 35% for the year (even including dividends), but the market itself is up 7.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 26% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.