Did You Manage To Avoid RN-Western Siberia's (MCX:CHGZ) 24% Share Price Drop?

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Public Joint Stock Company RN-Western Siberia (MCX:CHGZ) shareholders, since the share price is down 24% in the last three years, falling well short of the market return of around 33%. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 22% in the same timeframe.

Check out our latest analysis for RN-Western Siberia

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

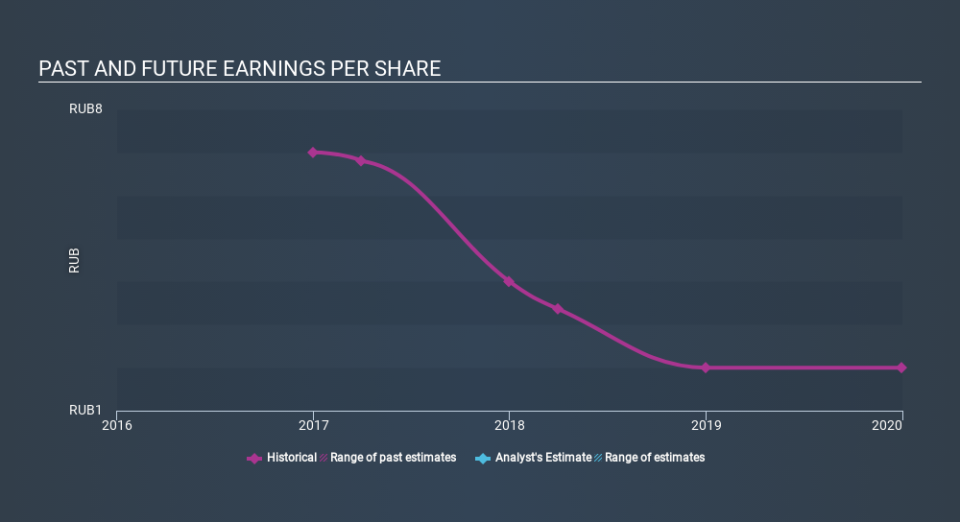

During the three years that the share price fell, RN-Western Siberia's earnings per share (EPS) dropped by 34% each year. In comparison the 8.9% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into RN-Western Siberia's key metrics by checking this interactive graph of RN-Western Siberia's earnings, revenue and cash flow.

A Different Perspective

RN-Western Siberia shareholders are down 14% for the year, but the market itself is up 0.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.0% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand RN-Western Siberia better, we need to consider many other factors. For example, we've discovered 5 warning signs for RN-Western Siberia (3 shouldn't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.