Did You Manage To Avoid Shanghai La Chapelle Fashion's (HKG:6116) Devastating 90% Share Price Drop?

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Shanghai La Chapelle Fashion Co., Ltd. (HKG:6116) for five whole years - as the share price tanked 90%. And we doubt long term believers are the only worried holders, since the stock price has declined 80% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 52% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Shanghai La Chapelle Fashion

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

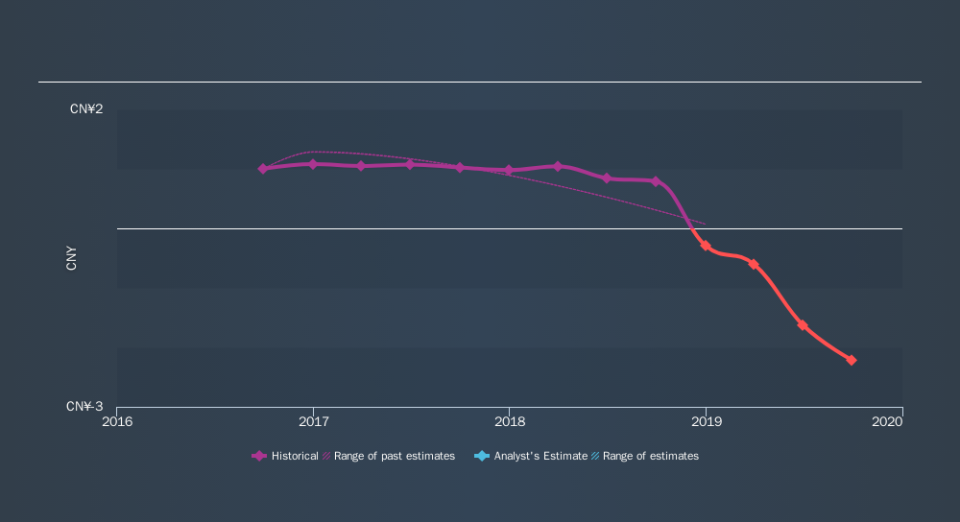

Over five years Shanghai La Chapelle Fashion's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Shanghai La Chapelle Fashion's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Shanghai La Chapelle Fashion's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Shanghai La Chapelle Fashion's TSR of was a loss of 86% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Shanghai La Chapelle Fashion shareholders are down 79% for the year, but the market itself is up 1.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 32% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Shanghai La Chapelle Fashion is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.