Did You Manage To Avoid Termbray Industries International (Holdings)'s (HKG:93) 46% Share Price Drop?

While it may not be enough for some shareholders, we think it is good to see the Termbray Industries International (Holdings) Limited (HKG:93) share price up 13% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 46%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Termbray Industries International (Holdings)

Termbray Industries International (Holdings) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Termbray Industries International (Holdings) saw its revenue shrink by 17% per year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 11% per year in that time. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

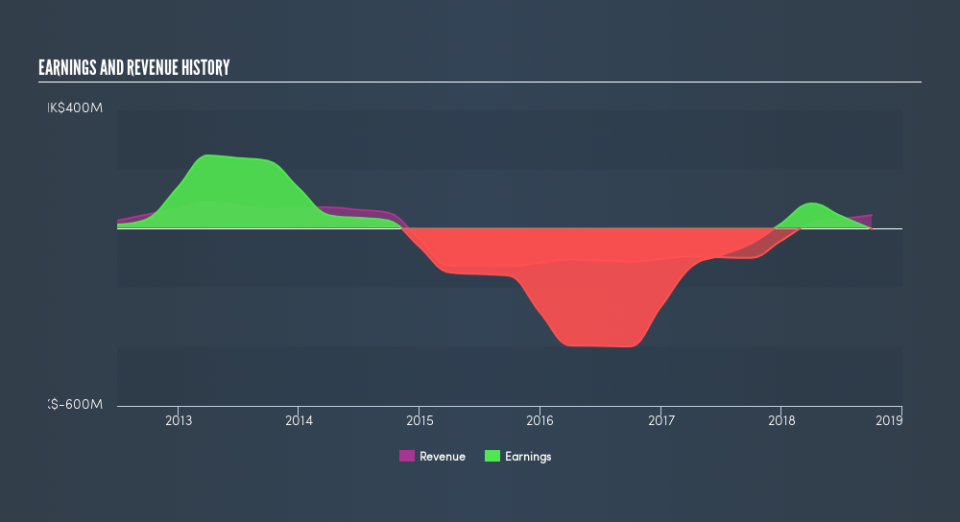

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Termbray Industries International (Holdings)'s earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Termbray Industries International (Holdings)'s total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Termbray Industries International (Holdings) hasn't been paying dividends, but its TSR of -38% exceeds its share price return of -46%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We regret to report that Termbray Industries International (Holdings) shareholders are down 26% for the year. Unfortunately, that's worse than the broader market decline of 3.6%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.2% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Termbray Industries International (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.