Did You Manage To Avoid Votum's (WSE:VOT) Painful 55% Share Price Drop?

Votum S.A. (WSE:VOT) shareholders will doubtless be very grateful to see the share price up 66% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 55% in that time. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Votum

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

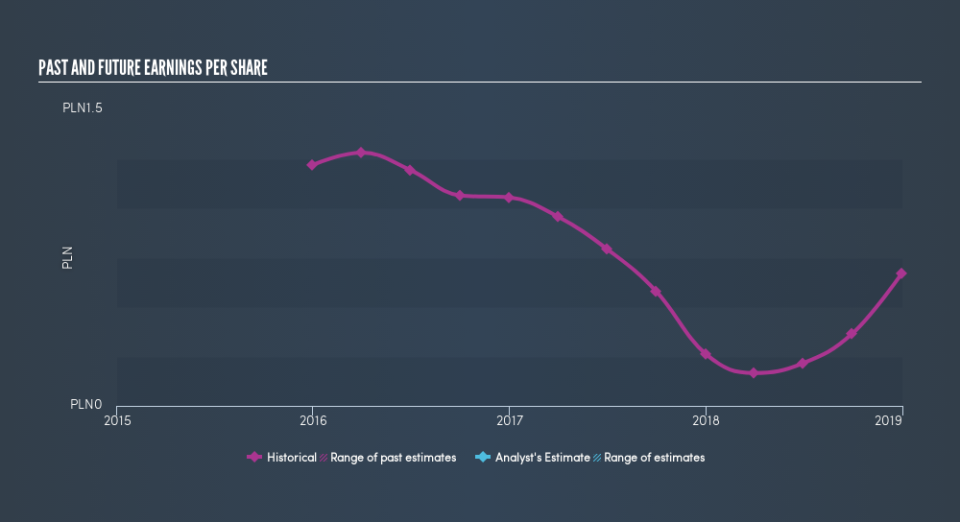

Votum saw its EPS decline at a compound rate of 18% per year, over the last three years. This reduction in EPS is slower than the 23% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 9.66.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Votum's key metrics by checking this interactive graph of Votum's earnings, revenue and cash flow.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Votum's TSR over the last 3 years is -50%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We regret to report that Votum shareholders are down 32% for the year. Unfortunately, that's worse than the broader market decline of 5.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3.5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on Votum you might want to consider these 3 valuation metrics.

But note: Votum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.