Did You Manage To Avoid Wan Cheng Metal Packaging's (HKG:8291) Painful 58% Share Price Drop?

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of Wan Cheng Metal Packaging Company Limited (HKG:8291) have suffered share price declines over the last year. To wit the share price is down 58% in that time. Wan Cheng Metal Packaging hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The silver lining is that the stock is up 3.3% in about a week.

Check out our latest analysis for Wan Cheng Metal Packaging

Wan Cheng Metal Packaging isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Wan Cheng Metal Packaging saw its revenue fall by 8.2%. That looks pretty grim, at a glance. The share price drop of 58% is understandable given the company doesn't have profits to boast of. Fingers crossed this is the low ebb for the stock. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

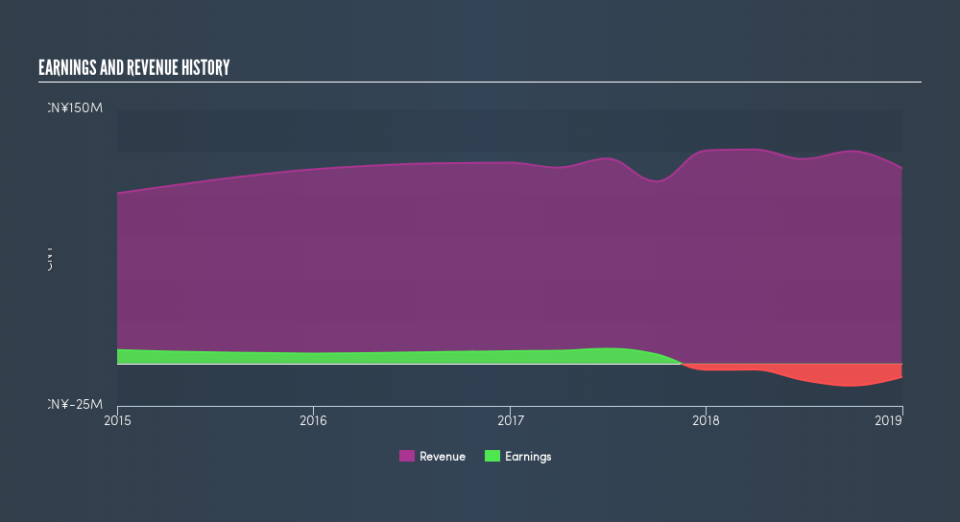

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Wan Cheng Metal Packaging shareholders are down 58% for the year, even worse than the market loss of 3.6%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 1.3% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. If you would like to research Wan Cheng Metal Packaging in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.