Did You Manage To Avoid WT Group Holdings's (HKG:8422) Devastating 75% Share Price Drop?

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a WT Group Holdings Limited (HKG:8422) shareholder over the last year, since the stock price plummeted 75% in that time. That'd be a striking reminder about the importance of diversification. WT Group Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 27% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

View our latest analysis for WT Group Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

WT Group Holdings managed to increase earnings per share from a loss to a profit, over the last 12 months.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

WT Group Holdings managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

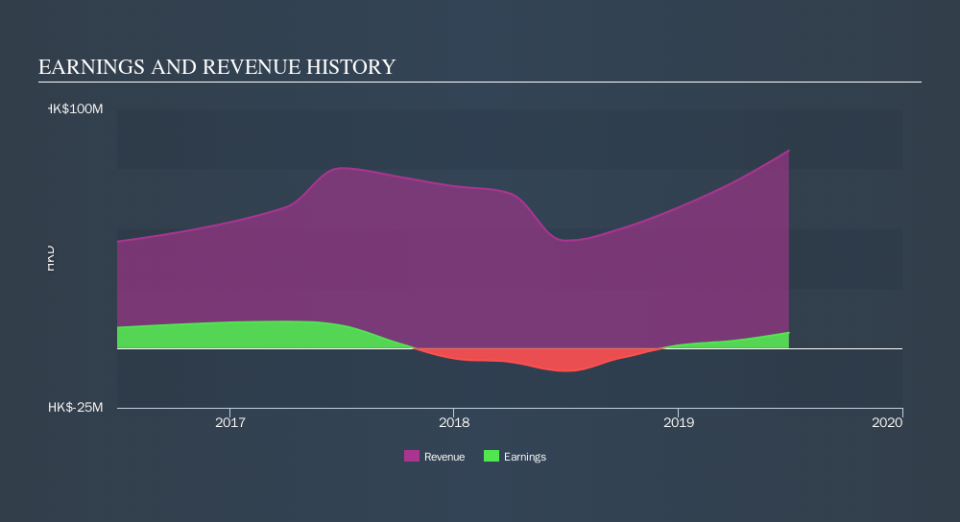

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

WT Group Holdings shareholders are down 75% for the year, even worse than the market loss of 2.4%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 27%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Is WT Group Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.