Did You Manage To Avoid Zhong Ao Home Group's (HKG:1538) Painful 51% Share Price Drop?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Zhong Ao Home Group Limited (HKG:1538) shareholders have had that experience, with the share price dropping 51% in three years, versus a market return of about 17%.

See our latest analysis for Zhong Ao Home Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Zhong Ao Home Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

We note that, in three years, revenue has actually grown at a 24% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Zhong Ao Home Group further; while we may be missing something on this analysis, there might also be an opportunity.

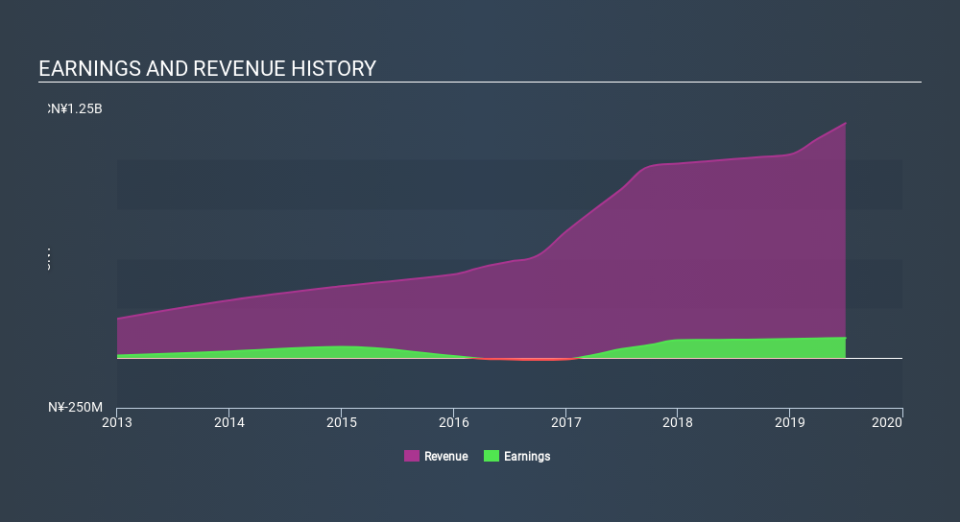

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Zhong Ao Home Group the TSR over the last 3 years was -47%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for Zhong Ao Home Group shares, which performed worse than the market, costing holders 3.9% , including dividends . The market shed around 0.4%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 19% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Importantly, we haven't analysed Zhong Ao Home Group's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Zhong Ao Home Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.