Did Maplewood International Real Estate Investment Trust's (CVE:MWI.UN) Share Price Deserve to Gain 35%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Maplewood International Real Estate Investment Trust (CVE:MWI.UN) share price is up 35% in the last year, clearly besting than the market return of around -2.0% (not including dividends). That's a solid performance by our standards! However, the stock hasn't done so well in the longer term, with the stock only up 6.9% in three years.

View our latest analysis for Maplewood International Real Estate Investment Trust

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

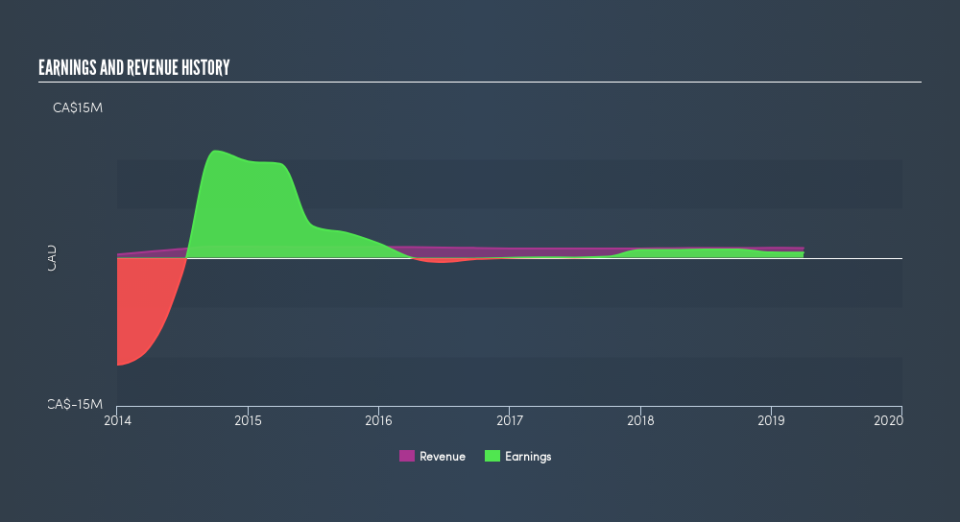

Over the last twelve months, Maplewood International Real Estate Investment Trust actually shrank its EPS by 33%. So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Maplewood International Real Estate Investment Trust's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Maplewood International Real Estate Investment Trust's TSR of 41% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that Maplewood International Real Estate Investment Trust has rewarded shareholders with a total shareholder return of 41% in the last twelve months. That certainly beats the loss of about 5.0% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.