Did You Miss Agro Phos (India)'s (NSE:AGROPHOS) Impressive 145% Share Price Gain?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Agro Phos (India) Limited (NSE:AGROPHOS) share price has soared 145% return in just a single year. On top of that, the share price is up 24% in about a quarter. Agro Phos (India) hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Agro Phos (India)

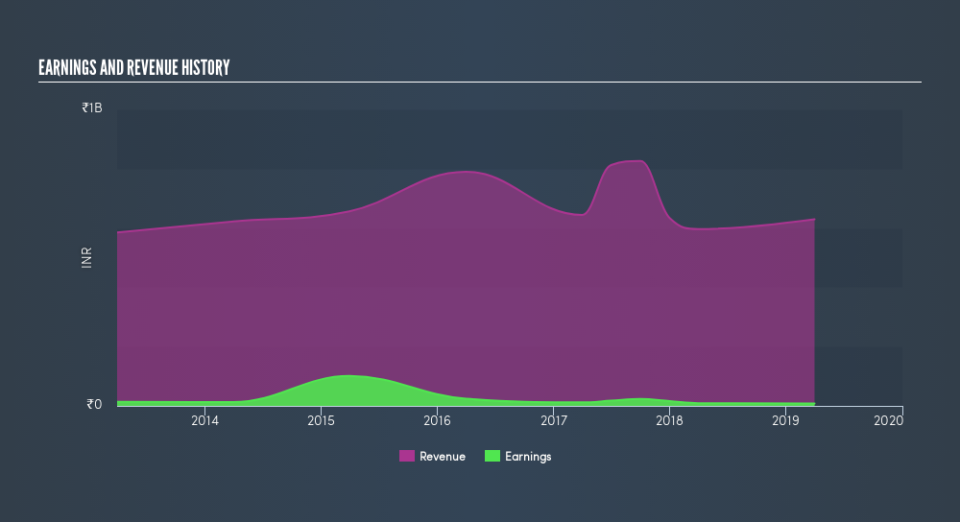

Given that Agro Phos (India) only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Agro Phos (India) saw its revenue grow by 5.5%. That's not a very high growth rate considering it doesn't make profits. So we wouldn't have expected the share price to rise by 145%. We're happy that investors have made money, though we wonder if the increase will be sustained. It's quite likely that the market is considering other factors, not just revenue growth.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Agro Phos (India)'s financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Agro Phos (India) shareholders have gained 146% over the last year, including dividends. The more recent returns haven't been as impressive as the longer term returns, coming in at just 24%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.