Did You Miss Credible Labs's (ASX:CRD) Impressive 151% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example Credible Labs Inc. (ASX:CRD). Its share price is already up an impressive 151% in the last twelve months. It's also good to see the share price up 103% over the last quarter. We'll need to follow Credible Labs for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Credible Labs

Credible Labs isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Credible Labs's revenue grew by 34%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 151%. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

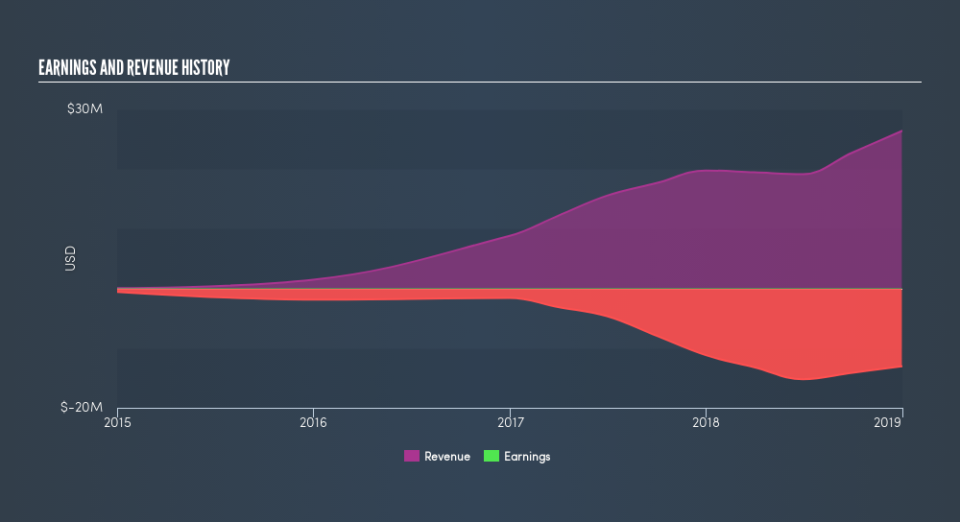

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Credible Labs stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Credible Labs shareholders should be happy with the total gain of 151% over the last twelve months. And the share price momentum remains respectable, with a gain of 103% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. You could get a better understanding of Credible Labs's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Credible Labs may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.