Did You Miss Delecta's (ASX:DLC) 100% Share Price Gain?

Delecta Limited (ASX:DLC) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But over three years, the returns would have left most investors smiling After all, the share price is up a market-beating 100% in that time.

Check out our latest analysis for Delecta

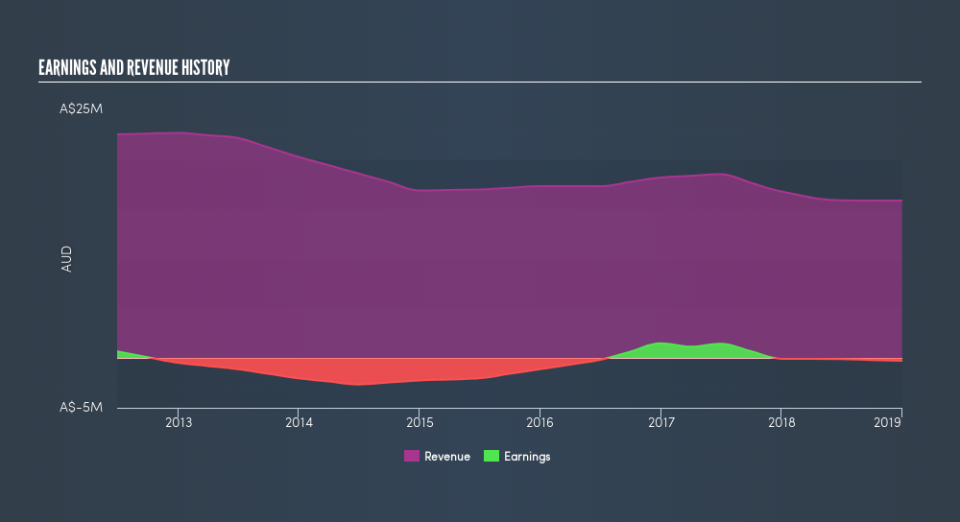

Delecta isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Delecta actually saw its revenue drop by 3.6% per year over three years. Despite the lack of revenue growth, the stock has returned 26%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Delecta shareholders have received a total shareholder return of 20% over the last year. Notably the five-year annualised TSR loss of 5.6% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Delecta better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.