Did You Miss Gigas Hosting's (BME:GIGA) Impressive 151% Share Price Gain?

While Gigas Hosting, S.A. (BME:GIGA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. The share price marched upwards over that time, and is now 151% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. If the business can perform well for years to come, then the recent drop could be an opportunity.

View our latest analysis for Gigas Hosting

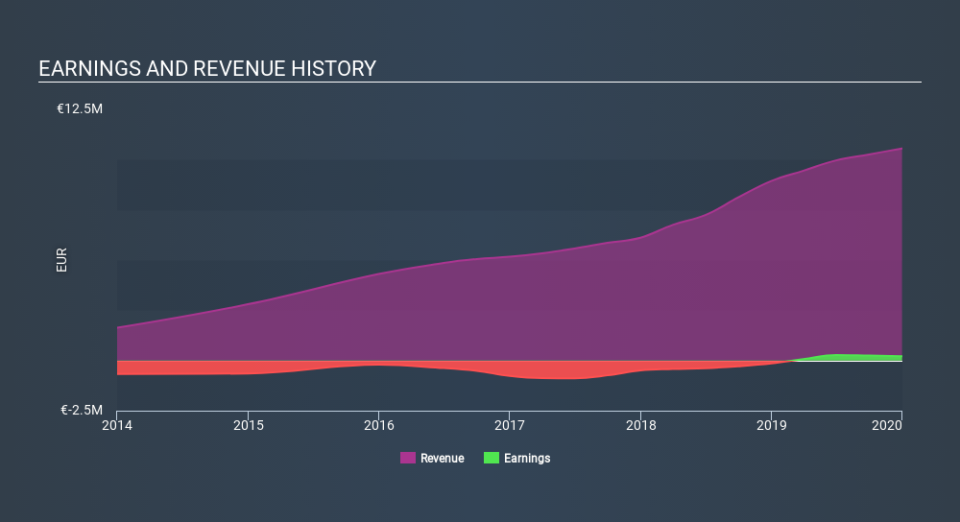

While Gigas Hosting made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years Gigas Hosting has grown its revenue at 27% annually. That's much better than most loss-making companies. Along the way, the share price gained 36% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Gigas Hosting has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Gigas Hosting's financial health with this free report on its balance sheet.

A Different Perspective

We can sympathize with Gigas Hosting about their 18% loss for the year, but the silver lining is that the broader market return was worse, at around -24%. Shareholders who have held for three years might be relatively sanguine about the recent weakness, given they have made 36% per year for three years. It's possible that the recent share price decline has more to do with the negative broader market returns than any company specific development. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Gigas Hosting has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.