Did You Miss Groupe LDLC société anonyme's (EPA:ALLDL) Impressive 120% Share Price Gain?

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Groupe LDLC société anonyme (EPA:ALLDL) share price had more than doubled in just one year - up 120%. Also pleasing for shareholders was the 58% gain in the last three months. Unfortunately the longer term returns are not so good, with the stock falling 56% in the last three years.

Check out our latest analysis for Groupe LDLC société anonyme

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Groupe LDLC société anonyme grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

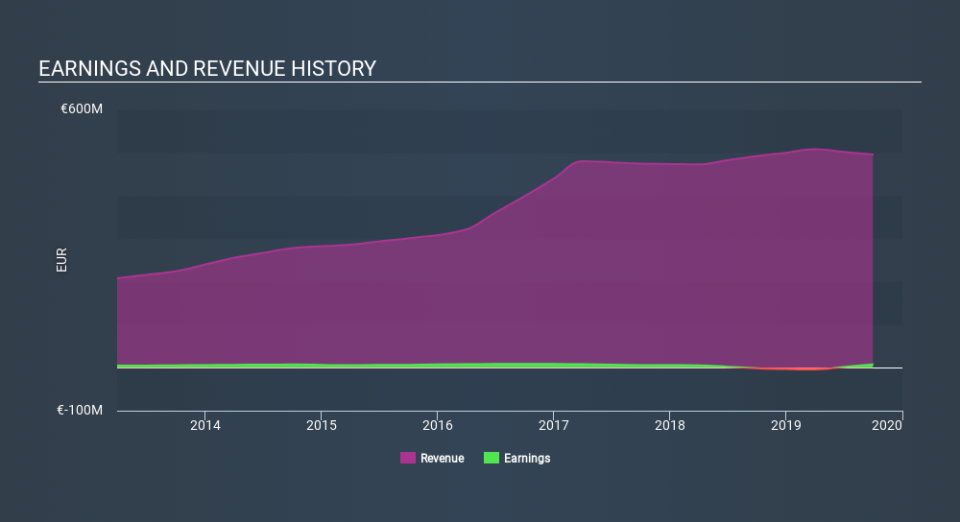

Revenue was pretty flat year on year, but maybe a closer look at the data can explain the market optimism.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Groupe LDLC société anonyme has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Groupe LDLC société anonyme

What about the Total Shareholder Return (TSR)?

We've already covered Groupe LDLC société anonyme's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Groupe LDLC société anonyme shareholders, and that cash payout contributed to why its TSR of 120%, over the last year, is better than the share price return.

A Different Perspective

It's good to see that Groupe LDLC société anonyme has rewarded shareholders with a total shareholder return of 120% in the last twelve months. Notably the five-year annualised TSR loss of 7.5% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Groupe LDLC société anonyme has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.