Did You Miss KAMAZ Publicly Traded's (MCX:KMAZ) Impressive 109% Share Price Gain?

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the KAMAZ Publicly Traded Company (MCX:KMAZ) share price has soared 109% in the last half decade. Most would be very happy with that.

View our latest analysis for KAMAZ Publicly Traded

KAMAZ Publicly Traded isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, KAMAZ Publicly Traded can boast revenue growth at a rate of 15% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 16% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes KAMAZ Publicly Traded worth investigating - it may have its best days ahead.

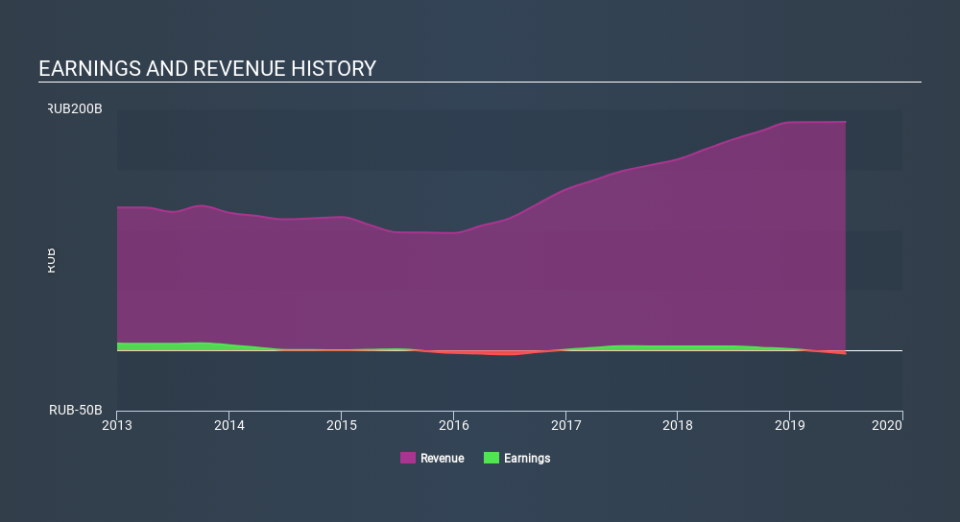

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between KAMAZ Publicly Traded's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that KAMAZ Publicly Traded's TSR of 114% over the last 5 years is better than the share price return.

A Different Perspective

KAMAZ Publicly Traded provided a TSR of 6.6% over the last twelve months. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 16% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You could get a better understanding of KAMAZ Publicly Traded's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course KAMAZ Publicly Traded may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.