Did You Miss LexinFintech Holdings' (NASDAQ:LX) -29% Share Price Gain?

Over the last month the LexinFintech Holdings Ltd. (NASDAQ:LX) has been much stronger than before, rebounding by 50%. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 29% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for LexinFintech Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, LexinFintech Holdings actually managed to grow EPS by 66% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

Revenue is actually up 24% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating LexinFintech Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

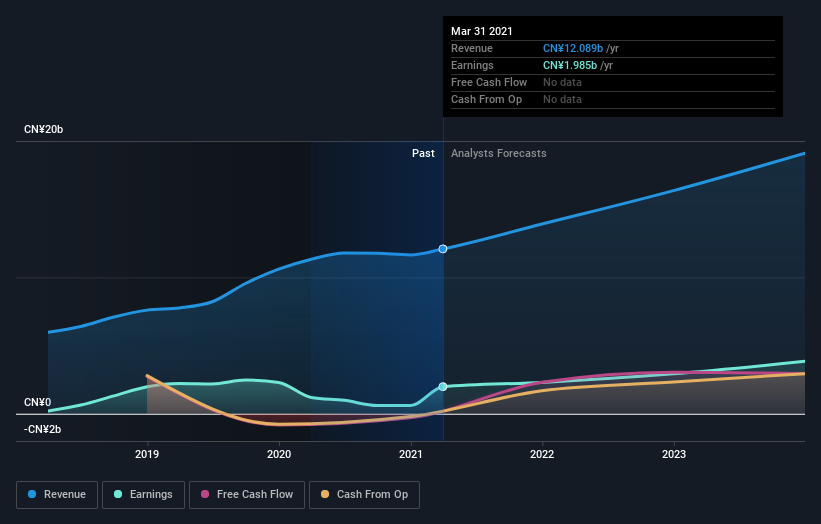

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

LexinFintech Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling LexinFintech Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Over the last year LexinFintech Holdings shareholders have received a TSR of 27%. Unfortunately this falls short of the market return of around 48%. The silver lining is that the recent rise is far preferable to the annual loss of 9% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand LexinFintech Holdings better, we need to consider many other factors. Take risks, for example - LexinFintech Holdings has 2 warning signs (and 1 which is significant) we think you should know about.

But note: LexinFintech Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.