Did You Miss Personalis' (NASDAQ:PSNL) 99% Share Price Gain?

Personalis, Inc. (NASDAQ:PSNL) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 99%.

View our latest analysis for Personalis

Personalis wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

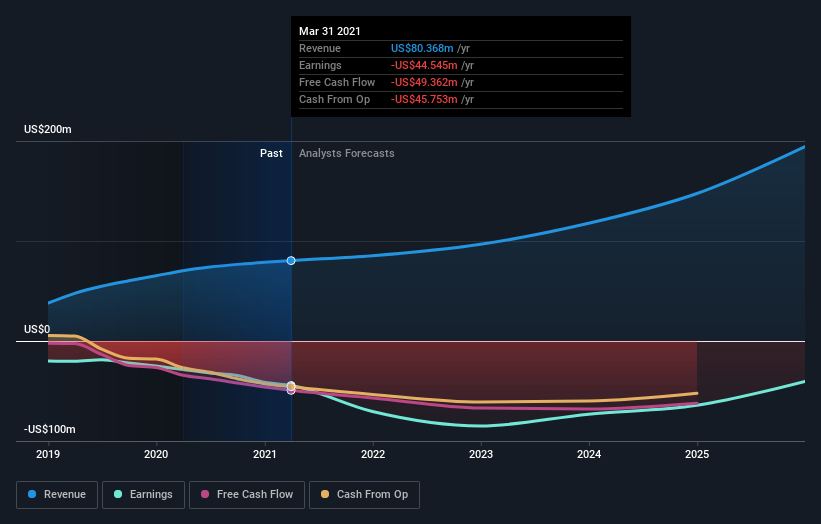

Personalis grew its revenue by 14% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 99% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Personalis' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Personalis shareholders should be happy with the total gain of 99% over the last twelve months. We regret to report that the share price is down 14% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Personalis that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.