Did You Participate In Any Of Choice Properties Real Estate Investment Trust's (TSE:CHP.UN) Respectable 40% Return?

- Oops!Something went wrong.Please try again later.

Thanks in no small measure to Vanguard founder Jack Bogle, it's easy buy a low cost index fund, which should provide the average market return. But you can make superior returns by picking better-than average stocks. For example, the Choice Properties Real Estate Investment Trust (TSE:CHP.UN) share price is up 18% in the last three years, slightly above the market return. Zooming in, the stock is up a respectable 17% in the last year.

View our latest analysis for Choice Properties Real Estate Investment Trust

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Choice Properties Real Estate Investment Trust actually saw its earnings per share (EPS) drop 75% per year.

So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the dividend payments explain the share price rise, since we don't see any improvement in that regard. It's much more likely that the fact that Choice Properties Real Estate Investment Trust has been growing revenue at 11% a year is seen as a genuine positive. In that case, the revenue growth might be more important to shareholders, for now, thus justifying a higer share price.

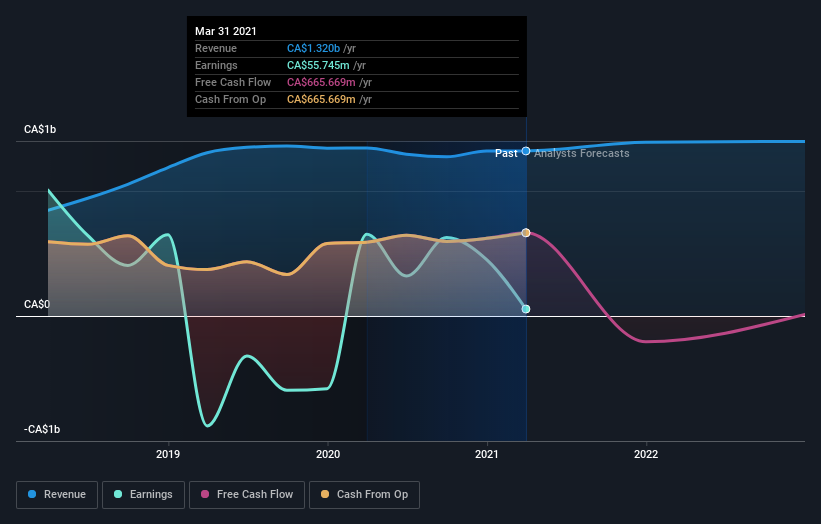

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Choice Properties Real Estate Investment Trust will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Choice Properties Real Estate Investment Trust's TSR for the last 3 years was 40%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Choice Properties Real Estate Investment Trust shareholders gained a total return of 24% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 7% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Choice Properties Real Estate Investment Trust has 5 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.