Did The Underlying Business Drive Apollo Healthcare's (TSE:AHC) Lovely 504% Share Price Gain?

Some Apollo Healthcare Corp. (TSE:AHC) shareholders are probably rather concerned to see the share price fall 33% over the last three months. But that isn't a problem when you consider how the share price has soared over the last year. In that time, shareholders have had the pleasure of a 504% boost to the share price. Arguably, the recent fall is to be expected after such a strong rise. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

It really delights us to see such great share price performance for investors.

See our latest analysis for Apollo Healthcare

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Apollo Healthcare went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 89% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

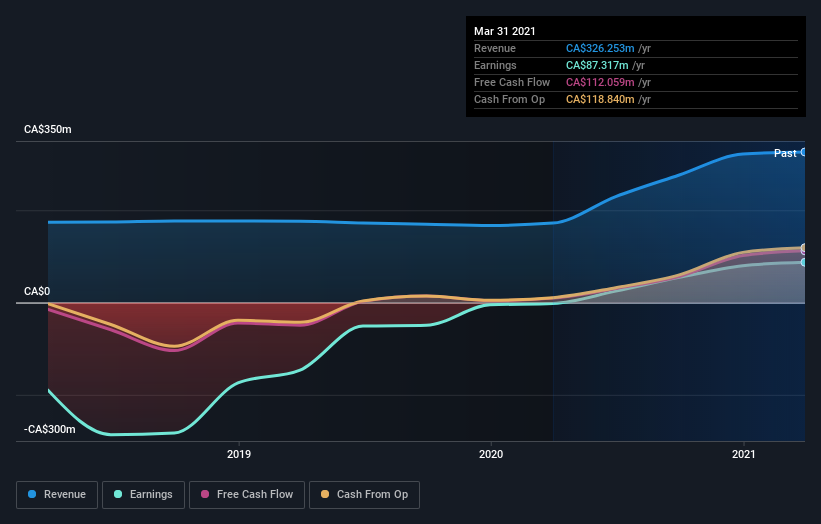

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Apollo Healthcare shareholders have gained 504% (in total) over the last year. That gain actually surpasses the 11% TSR it generated (per year) over three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Apollo Healthcare better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Apollo Healthcare you should know about.

Apollo Healthcare is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.