Is Dierig Holding (ETR:DIE) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Dierig Holding AG (ETR:DIE) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Dierig Holding

How Much Debt Does Dierig Holding Carry?

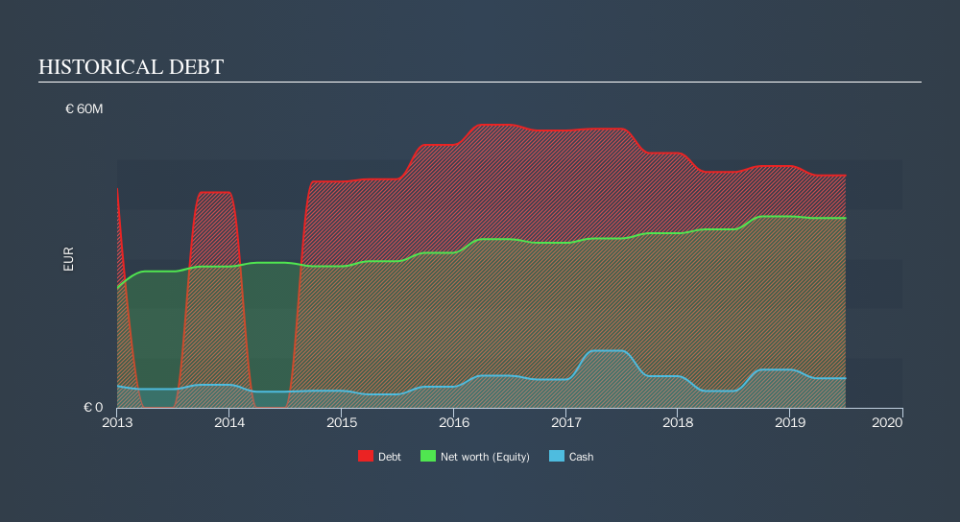

As you can see below, Dierig Holding had €46.7m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of €5.91m, its net debt is less, at about €40.8m.

How Strong Is Dierig Holding's Balance Sheet?

We can see from the most recent balance sheet that Dierig Holding had liabilities of €27.6m falling due within a year, and liabilities of €52.9m due beyond that. Offsetting this, it had €5.91m in cash and €11.4m in receivables that were due within 12 months. So it has liabilities totalling €63.2m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €71.4m, so it does suggest shareholders should keep an eye on Dierig Holding's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 6.8, it's fair to say Dierig Holding does have a significant amount of debt. However, its interest coverage of 4.9 is reasonably strong, which is a good sign. Importantly, Dierig Holding's EBIT fell a jaw-dropping 31% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Dierig Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Dierig Holding generated free cash flow amounting to a very robust 97% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

To be frank both Dierig Holding's net debt to EBITDA and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Dierig Holding stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Dierig Holding's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.