Digital vaults let you store end-of-life documents and help your loved ones find them easily

Every year, Facebook sends North Carolina-based technology writer Christina Wood a reminder to wish her sister a happy birthday. Sometimes, she says, it tries to lure her back to her sister’s Facebook page by saying that her sister hasn’t heard from her in a while.

The constant reminders are annoying at best, but mostly they’re just painful. Wood’s sister died in 2014.

“It was unexpected and tragic,” Wood says over text message. “And now, there’s nothing I can do to stop the Facebook reminders because she didn’t tell anyone her password before she died. I’ve tried to contact Facebook many times and nothing has worked. I’ve never had any response from them at all. That’s just one element of her digital life that reaches out like a ghost, pretending she’s still with us,” Wood explains.

While you can't stop individual birthday reminders, it is possible to change your settings so you can stop receiving them altogether. You can also block painful memories from showing up in your timeline by filtering out certain people or dates.

► Digital afterlife: What happens to your Facebook and Twitter accounts after you die?

Wood also worries there might be bank accounts the family doesn’t know about, friends wondering why her sister never writes, photo collections and so much more Wood's family will never uncover. Wood's says she often wished there were something to help people who are grieving before they have to become a sort of de facto detective and decision-maker. Now, there is.

A growing number of personal digital-vault companies offer ways to organize, store and protect your personal, financial and digital information while you’re alive. They also help your loved ones access it all quickly and safely when you’re gone.

A growing need for post-life information

Two out of 3 people in America don’t have a will – digital or otherwise – in 2021, according to a recent survey by aging-support site Caring.com. While the COVID-19 pandemic pushed more young people – 63% more in the 18-34 age range over the past year – to create wills and estate plans, older adults are less likely to have them today than before the pandemic.

The biggest barriers for most people? They “don’t know how to get one," "haven't gotten around to it yet" or feel they "don't have enough assets to leave anyone," Caring’s 2021 Wills and Estate Planning Study found.

Also of concern? The average person under the age of 70 has more than 160 digital accounts and more than $58 billion is unaccounted for when people die, according to Legacy Concierge. Legacy is one of several personal storage vault companies that have cropped up in recent years to help people like Wood.

In general, these companies charge a fee to help people locate every single account and document the dead leave behind, from legal and financial documents like wills, estate plans, bank accounts to online photos and family tree information. They'll even track down loyalty cards and mileage points. These services organize and manage it all in one place and promise backups and bank-level security.

Here are several options:

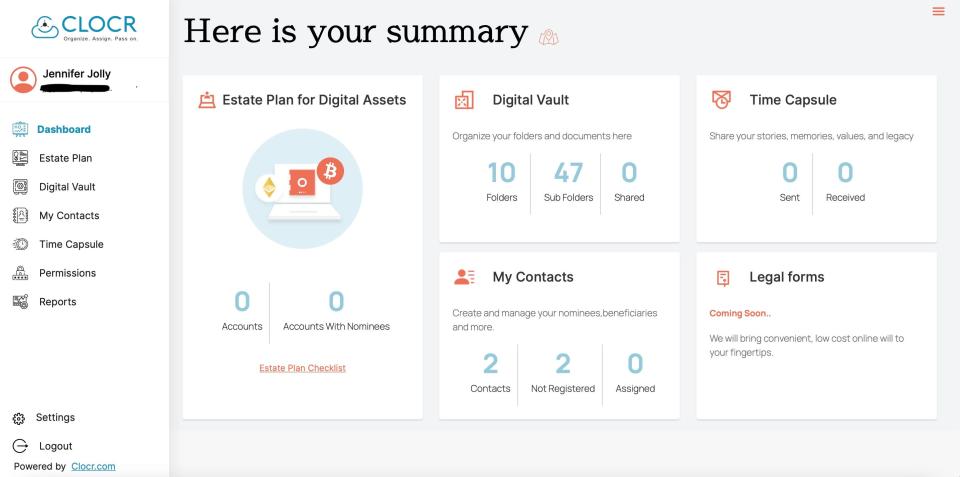

Clocr

Apoorva Chintala was just 15 years old when she came up with the idea of Clocr (short for Cloud locker). Her grandfather died in India, leaving not only a grieving family in America but forcing her father, Sree, to manage his late father’s affairs from Austin, Texas.

“My father was thrust into the role of ‘executor’ and forced to try and determine what my grandfather’s wishes had been and how to disburse his assets,” Chintala said over the phone. “All of these new responsibilities for my father, while important and urgent, seemed trivial in comparison to our loss.”

Apoorva says the experience made her wonder what she would do if she were ever in the same situation. “That’s how I came up with the idea for Clocr. Our primary goal is to ease a family’s burden at their greatest time of need when they are facing the greatest uncertainty of life – it’s ending,” Chintala added.

I’ve been using Clocr for the past three months. Once you sign up and create a login, it guides you through what types of documents to include based on your particular needs. For example, if you have children under the age of 18, Clocr creates specific folders for each child and encourages you to include guardianship forms and 529 college savings plans, among others. It took me the better part of two days to locate every single account, update passwords and create new documents (like a will and medical proxy) that I’ve meant to get to for years.

You can assign it all to one person or give various aspects of your digital and personal estate to different people. You also dictate the level of access each person can have throughout the entire process. You can even write messages for future generations in the Time Capsule and send photos, recipes or reminders to people you care about once you’re gone.

Clocr's plan cost $4.99 a month for the first year or $299 per year if purchased in 2021. (At the time I’m writing this, the company also has a 90-day free trial period.)

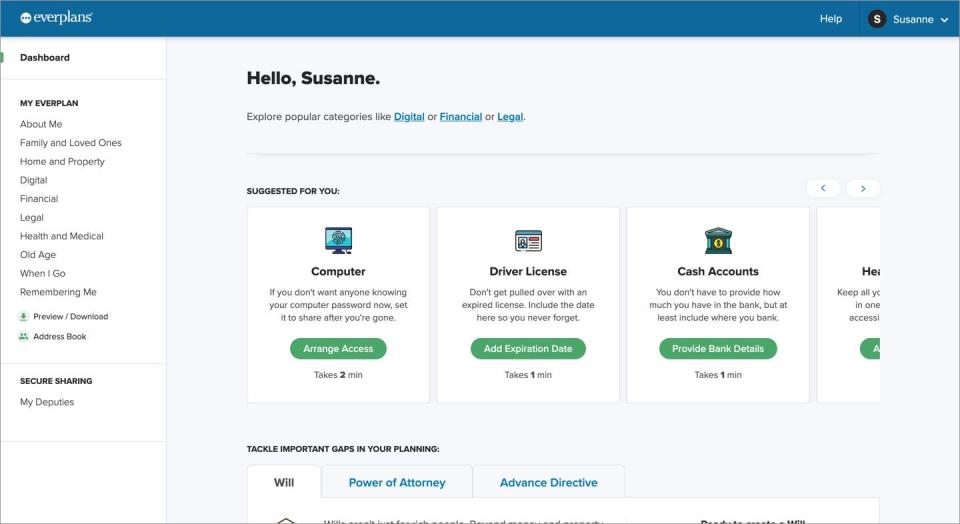

Everplans

Everplans is another company that takes a holistic approach to curate and manage your online – and offline – affairs. In an email, Everplans co-founder Abby Schneiderman explained that most people have no idea what they leave behind or the stress it might cause family or friends trying to sort it out when they’re gone.

“When people think of end-of-life planning, they assume it only involves legal or medical documents like a will, advance directive or planning a funeral when in reality there’s an entire universe of information required that’s often overlooked,” Schneiderman wrote. “Passwords have become the modern-day keys to our lives. In addition, financial accounts and insurance policies need to be located and important contacts can be extremely helpful in a time of need,” she said.

Will your heirs know how to unlock your phone, find your bank account, understand who holds the mortgage or how to access the files on your computer? Like Clocr, Everplans takes you through documenting all of this, one interview question at a time, then keeps it all safe online where only the person – or people – you designate can access it. You can even plan your funeral and write your own obituary.

“The sum of your life isn’t simply numbers, tasks, legal documents and possessions,” Schneiderman adds. “On paper, most of us are pretty much the same, give or take a few zeros. The real meaning of your life is what you experienced, how you affected other people, how they affected you and the lessons you want to live on after you’re gone,” she remarked.

The National Guardian Life Insurance Co. acquired Everplans earlier this year. It offers a free 60-day trial then costs $75 per year.

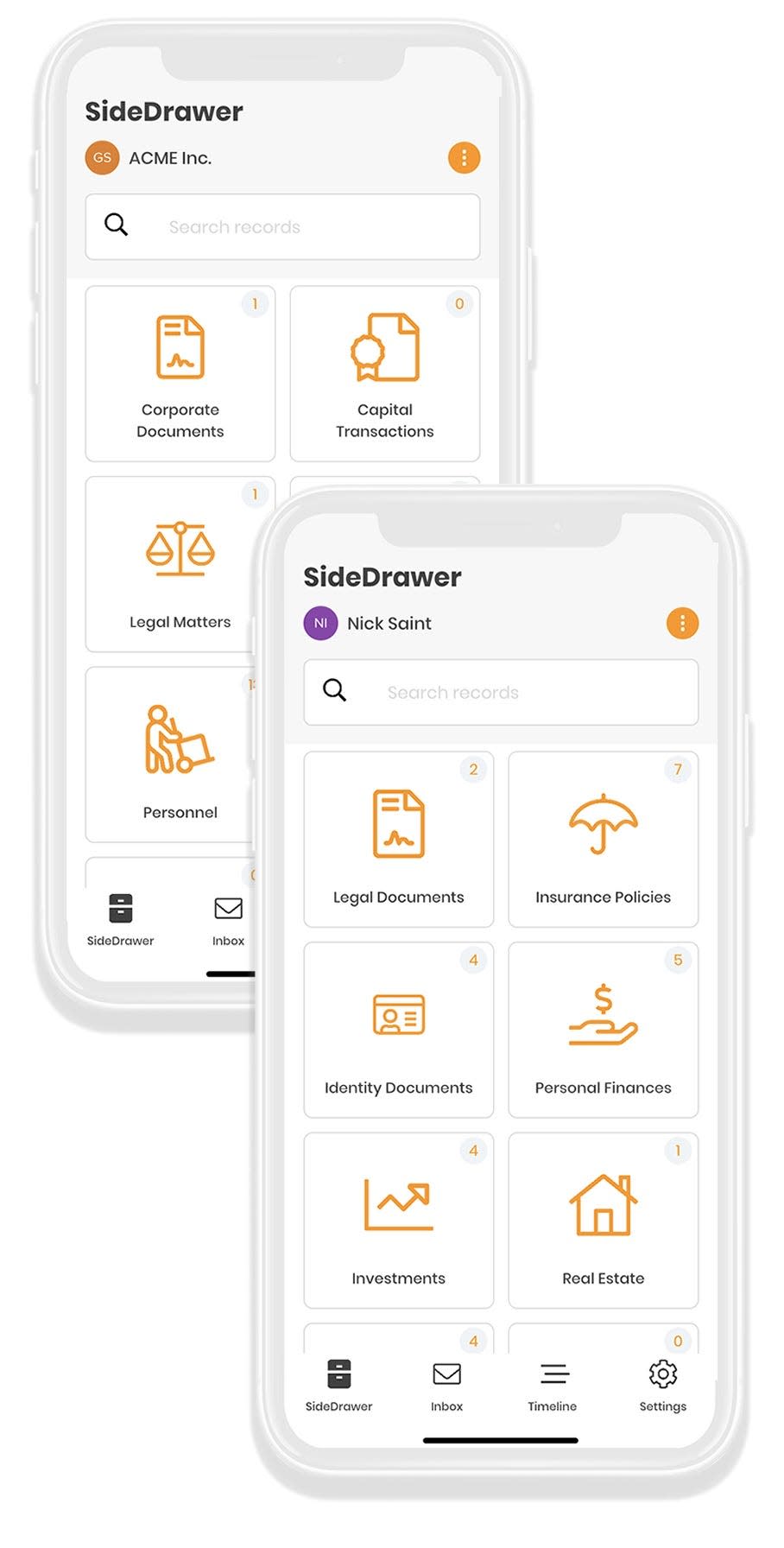

SideDrawer

Toronto-based SideDrawer is more of a wealth-management platform, designed to keep all your financial, insurance, taxes, legal documents, health information and details about your belongings, all securely in one place online. The site has a filing cabinet design, with different folders for each kind of document and you can upload all of your essential information with a simple snap or scan from the companion smartphone app.

You can also share this data with collaborators – like a spouse or family member – to keep everyone on the same page. It also helps you create SideDrawers for your kids and hand all their important documents and accounts over to them when they are old enough to manage it themselves.

SideDrawers’ website says the company uses Amazon’s data centers as its primary storage site, which it says are ISO 27001, SOC 2 (Type II)-certified and compliant with other industry safeguards.

The company offers a free-for-life version, which lets you add up to 10 online folders and one collaborator, but most people will need more than that. It costs $6 a month or $60 per year for unlimited folders and collaborators.

There are a few other companies that offer similar features, such as AfterVault ($9.99/month $69 per year or $299 for lifetime membership), but its website says it’s not currently accepting new registrations.

Legacy Concierge asks you to do a 15-minute “discovery call” with a company representative before choosing a plan. Legacy charges a $75 one-time setup fee and $75 per year. In event of death or disability, the company can locate, control, curate and collect digital assets ranging from insurance policies to gym memberships. Prices for that service, called Lockyt, range from $250 for one account up to $9,500 for multiple accounts. The fees are paid by the estate.

Final considerations

Estate planning experts say the biggest caveats to using personal storage vaults are making sure to keep a backup copy of all of the plans in a safe deposit box, with another family member or with an attorney.

And since you are relying on a third party to keep all of your passwords safe, they say it’s a good idea to double-check the site’s digital safety certifications and how they’ll protect you in case of a hack.

Still, people like Christina Wood can’t imagine going through another loss without this kind of information safely tucked away. “No one wants to think about what happens to any of this when they are alive. But for those of us left behind, it will make all the difference in the world,” Wood said

Jennifer Jolly is an Emmy Award-winning consumer tech columnist. Email her at jj@techish.com. Follow her on Twitter: @JenniferJolly.

The views and opinions expressed in this column are the author’s and do not necessarily reflect those of USA TODAY.

Jennifer Jolly is an Emmy Award-winning consumer tech columnist. Email her at jj@techish.com. Follow her on Twitter: @JenniferJolly. The views and opinions expressed in this column are the author’s and do not necessarily reflect those of USA TODAY.

This article originally appeared on USA TODAY: Estate planning: How to store your end-of-life instructions online