The DigiTouch (BIT:DGT) Share Price Is Up 13% And Shareholders Are Holding On

DigiTouch S.p.A. (BIT:DGT) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But at least the stock is up over the last three years. However, it's unlikely many shareholders are elated with the share price gain of 13% over that time, given the rising market.

Check out our latest analysis for DigiTouch

We don't think that DigiTouch's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

DigiTouch's revenue trended up 7.8% each year over three years. That's not a very high growth rate considering it doesn't make profits. In that time the share price is up 4.3% per year, which is not unreasonable given the revenue gorwth. Ultimately, the important thing is whether the company is trending to profitability. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

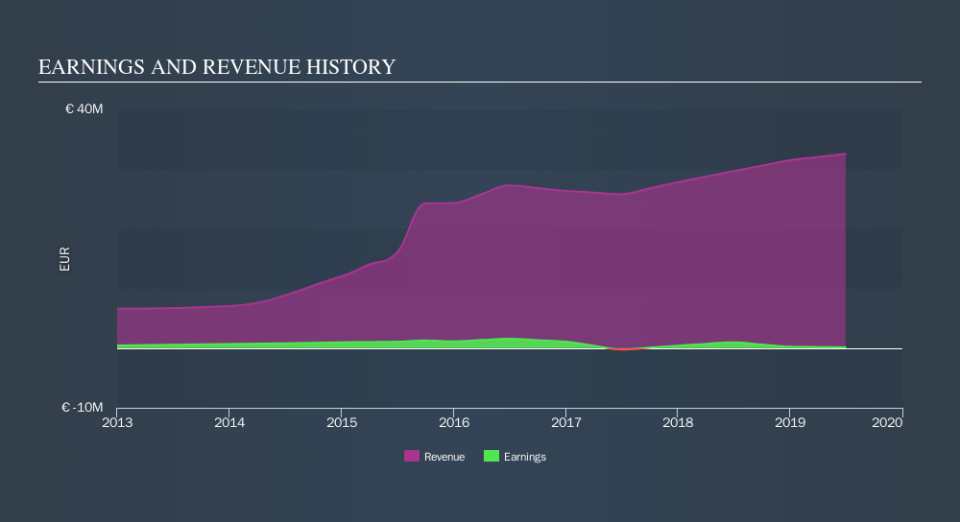

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for DigiTouch the TSR over the last 3 years was 18%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Over the last year DigiTouch shareholders have received a TSR of 6.0%. Unfortunately this falls short of the market return of around 15%. On the bright side that gain is actually better than the average return of 5.8% over the last three years, implying that the company is doing better recently. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like DigiTouch better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.