We Discuss Whether Vuzix Corporation's (NASDAQ:VUZI) CEO Is Due For A Pay Rise

The impressive results at Vuzix Corporation (NASDAQ:VUZI) recently will be great news for shareholders. This would be kept in mind at the upcoming AGM on 17 June 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

See our latest analysis for Vuzix

Comparing Vuzix Corporation's CEO Compensation With the industry

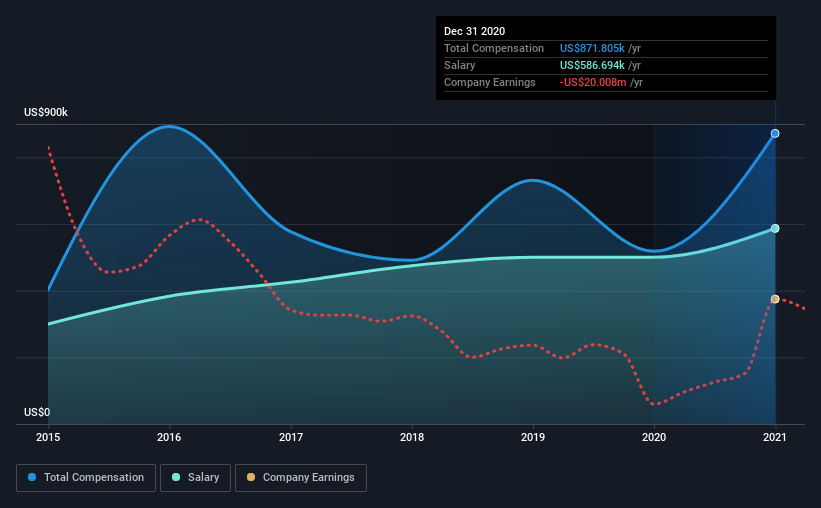

At the time of writing, our data shows that Vuzix Corporation has a market capitalization of US$1.1b, and reported total annual CEO compensation of US$872k for the year to December 2020. Notably, that's an increase of 68% over the year before. We note that the salary portion, which stands at US$586.7k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$2.0m. This suggests that Paul Travers is paid below the industry median. Furthermore, Paul Travers directly owns US$51m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$587k | US$500k | 67% |

Other | US$285k | US$18k | 33% |

Total Compensation | US$872k | US$518k | 100% |

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. It's interesting to note that Vuzix pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Vuzix Corporation's Growth

Vuzix Corporation's earnings per share (EPS) grew 17% per year over the last three years. In the last year, its revenue is up 105%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Vuzix Corporation Been A Good Investment?

Most shareholders would probably be pleased with Vuzix Corporation for providing a total return of 144% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which can't be ignored) in Vuzix we think you should know about.

Important note: Vuzix is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.