Disney: Buffett's $8 Billion Mistake

- By Rupert Hargreaves

Warren Buffett (Trades, Portfolio) has famously declared that the worst mistake he's ever made is buying Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) in the first place. Previously, he has called this his "$200 billion" mistake.

Warning! GuruFocus has detected 2 Warning Signs with FSM. Click here to check it out.

The intrinsic value of DIS

Of course, one of the things with trying to analyze mistakes like buying Berkshire is that it requires a great deal of speculation. If Buffett hadn't bought Berkshire would he really be $200 billion richer today? Or would he have made another more costly (possibly terminal) mistake further down the road? We just don't know the answer to this question.

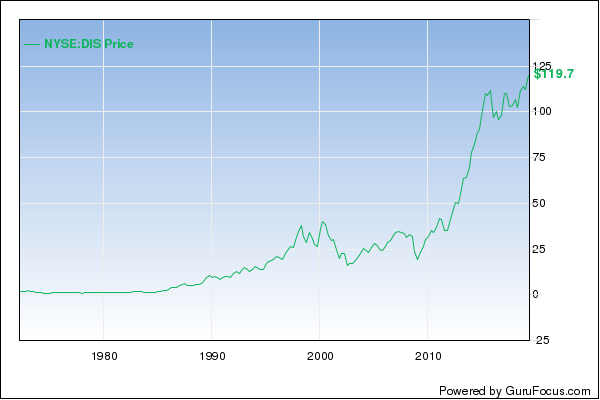

However, what we can tell for sure is how much Buffett missed out on by selling investments too early. Buffett is one of the world's most high profile investors who has built a reputation for himself as an ultra-long-term investor. When he buys, he rarely ever sells. But one stock he did sell back in the 1960s, which has since gone on to become one of the world's most valuable companies, and one of the most recognizable brands ever to have existed is Disney (DIS).

Buffett's Disney experience

Buffett first noticed Disney in 1966. The company at the time was selling for $80 million in market with a debt-free balance sheet. Even though it did not have the reputation that it does today, at the time Disney was still a recognizable brand and the young investor went to meet Walt Disney, who showed him around the company's theme park. Disney pointed out a new ride, which was costing $17 million to construct. Buffett quickly realized that the whole company was selling for the same price as a few of its rides, excluding any rights to past or future films (at the time the company had over 200 films in its portfolio as well as a theme park that attracted 9 million customers a year).

Liking the economics and company's potential, the future Oracle of Omaha used $4 million of his partnership capital to buy a 5% ownership stake. A year later Buffett sold for around $6 million, netting a 50% return in 12 months -- not bad.

But Disney was only just getting started. Unfortunately, Walt Disney died in 1966, the same year Buffett invested, which put a cloud over the company. It would have been difficult at the time to see just how much potential this business had. Between 1967 and 1983, the company floundered without much direction, and made several unsuccessful attempts to diversify into other businesses. It revealed plans to build a cable network and entered into an agreement with an airline to become the official airline of Walt Disney World. The Disney Channel started broadcasting in 1983, a year after Coca-Cola tried to acquire the business unsuccessfully.

In 1984, corporate raider Saul Steinberg acquired an 11% stake in the business and offered to buy 49% of the rest of the shares at up to $72.50 per share. The board of directors ultimately settled with Steinberg, buying him out for $300 million and paying him $28 million more for "out-of-pocket expenses." Steinberg later agreed to pay (1989) a $45 million cash settlement to parties who sued him over this greenmail action.

It was not until the 1990s that Disney regained direction and started to grow again. Management pursued an international expansion plan and doubled down on the company's film production, reinforcing its brand in the minds of consumers around the world.

A costly mistake

How much did this mistake cost Buffett? Today Disney is worth just under $167 billion, a 5% stake would be worth $8.4 billion. Still, as I said at the beginning of the article, it is always difficult to calculate lost profits because we just don't know what the situation might have been if Buffett continued to own and didn't sell Disney. Nonetheless, reviewing historical cases like this is always interesting.

Disclosure: The author owns shares in Berkshire Hathaway.

Read more here:

Warren Buffett and Insurance

Digging Deeper Into Buffett's Travelers Purchase

Re-Learning Lessons From Buffett's Best Essay

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with FSM. Click here to check it out.

The intrinsic value of DIS