Disney (DIS) Unveils New Cruise Ship, Shanghai Park Reopens

The Walt Disney Company DIS recently unveiled Disney Wish, its first new cruise ship in a decade. The 4000-passenger ship weighs 144,000 tons and is the fifth vessel in Disney’s fleet, per a Reuters article.

Disney also reopened its Shanghai Disney Resort theme park on Jun 29, following a three-month closure (from Mar 21) due to rising coronavirus infections. Park authorities have put restrictions on capacity, and some attractions, such as Marvel Universe, will stay closed.

The cruise and theme parks businesses are part of the Parks, Experiences & Consumer Products segment that accounted for 34.6% of second-quarter fiscal 2022 revenues. These businesses have suffered significantly due to coronavirus-induced lockdowns and travel restrictions.

However, as lockdowns and restrictions were lifted across the globe, the segment reported growth in the fiscal second quarter. While Parks, Experiences and Products revenues surged 109.6% year over year to $6.65 billion, operating income was $1.75 billion against the year-ago quarter’s operating loss of $406 million.

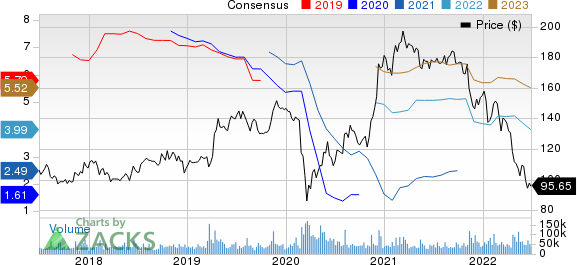

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

What Awaits Disney Stock in the Rest of 2022?

Disney shares are having a terrible 2022. The company’s profitability is expected to be negatively impacted by higher investments in content, which will drive up programming and production costs at Media and Entertainment Distribution. Disney now expects to cut overall film and TV spending by $1 billion to $32 billion in fiscal 2022.

Closure of theme parks in Asia due to the coronavirus is also expected to reduce operating income by up to $350 million in the fiscal third quarter.

Disney’s leveraged balance sheet also remains a concern. As of Apr 2, 2022, cash and cash equivalents were $13.27 billion against total borrowings of $46.6 billion.

Disney shares have declined 38.3% year to date compared with the Zacks Consumer Discretionary sector’s decline of 35.1% on a year-to-date basis.

Nevertheless, Disney benefits from the growing popularity of Disney+ owing to a strong content portfolio and a cheaper bundle offering. Availability in the Nordics, Latin America and other Asian territories is helping it expand its user base.

Disney+ has emerged as a key growth driver for Disney, primarily driven by its solid content portfolio. Disney has an impressive line-up of big-budget movies slated to be released over the next couple of years, a number of which will appear on Disney+ simultaneously with their theatrical releases.

Disney recently began offering its streaming service, Disney+, in 16 countries across the Middle East and North Africa. Thanks to its robust content portfolio, the company remains on track to achieve its guidance of 230-260 million paid subscribers for Disney+ by the end of fiscal 2024. Expansion into the Middle East and North Africa will further help Disney in its cause.

Disney’s expanding streaming service offerings — Disney+, ESPN+, Hulu, Disney+ Hotstar (India, Indonesia, Malaysia and Thailand) and Star+ (Latin America) — are expected to be major growth drivers in the long run.

Disney+ garnered 137.7 million paid subscribers within a short span of its availability (launched on Nov 12, 2019). Hulu and ESPN+ had 45.6 million and 22.3 million paid subscribers, respectively, at the end of second-quarter fiscal 2022. Expanding subscriber base is expected to boost Direct-to-Consumer (“DTC”) revenue growth. The company’s DTC services include Disney+, Hulu and ESPN+.

Zacks Rank & Stocks to Consider

Disney currently has a Zacks Rank #3 (Hold).

Cumulus Media CMLS, Gray Television GTN and Cable One CABO are better-ranked stocks in the broader sector.

Both Cumulus Media and Gray Television sport a Zacks Rank #1 (Strong Buy). Cable One has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Cumulus Media, Gray Television and Cable One have been down 30.7%, 15% and 28.8% on a year-to-date basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Cumulus Media, Inc. (CMLS) : Free Stock Analysis Report

Gray Television, Inc. (GTN) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research