Disney is the Yahoo Finance Company of the Decade

The Walt Disney Company had quite a year in 2019, from closing its acquisition of 21st Century Fox in March to opening its giant Galaxy’s Edge attraction at Disney World in August to launching its Disney+ streaming service in November, all adding up to a strong case for Company of the Year. But that honor for 2019 went to Target, which made major gains in e-commerce and profit margins, and saw its stock rise 95% this year. (Disney’s shares only rose 35%.)

Instead, Disney is our Company of the Decade, the first time Yahoo Finance has bestowed that honor. We first began naming a Company of the Year in 2013. The choice that year? Disney.

[See previous Yahoo Finance Companies of the Year: Target; Square; Amazon; Nvidia; Facebook; Under Armour; Disney.]

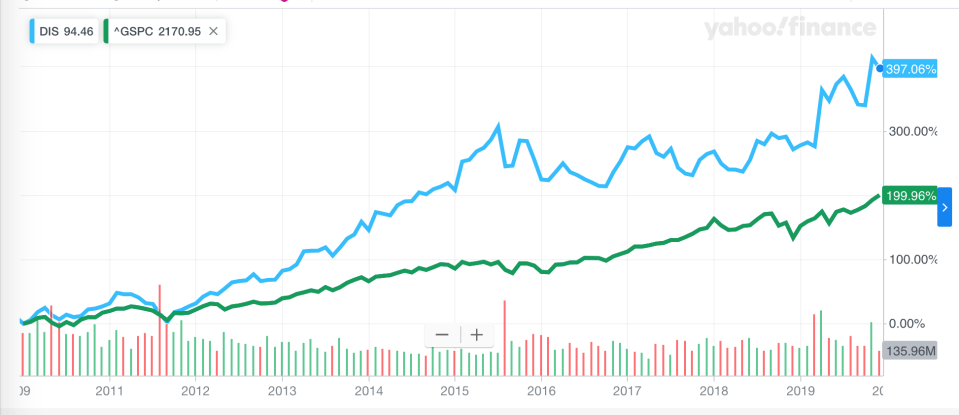

Our annual Company of the Year choice is typically stock-driven, since stock performance is what our readers care most about. The Company of the Year is not necessarily the No. 1 best-performing stock of that year, but it’s almost always in the top five. Disney is not one of the top 10 or even top 20 stocks of the past decade. Shares are up about 400% since December 2009 (the S&P rose 200% in that time, the Dow 180%), while tech names like Netflix, Amazon, AMD and Broadcom all rose more than 1,000%.

But what Disney (DIS) has achieved as an organization in 10 years is remarkable.

It acquired Lucasfilm and Fox; put out five new Star Wars blockbusters, three of them topping $1 billion at the global box office; put out 21 Marvel Cinematic Universe movies, nine of them topping $1 billion; had 24 movies in the decade top $1 billion at the global box office—more than half of the 44 total movies to ever top $1 billion; acquired the most lauded back-end video streaming company from Major League Baseball; and launched two ambitious subscription streaming services (ESPN+ and Disney+) and bought a third (Hulu).

Read on for some of the highlights from Disney’s decade.

Lucasfilm acquisition

Bob Iger rose all the way from ABC Sports to COO of Disney under Michael Eisner, and finally CEO in 2005. Once he took the reins, he quickly began buying. In 2006, he convinced Steve Jobs, John Lasseter, and Ed Catmull to sell Pixar for $7.4 billion. In 2009, he convinced Marvel chairman Ike Perlmutter to sell Marvel for $4 billion.

Negotiating with George Lucas was not as easy. Lucas originally wanted “the Pixar deal,” Iger wrote this year in his book “The Ride of a Lifetime.” But there was no way Iger was paying $7 billion for Lucasfilm: “We already sensed Lucasfilm was potentially quite valuable for us, but it wasn’t worth $7.4 billion,” he wrote in his book. Pixar had six movies already in production when Disney bought it, plus a staff of engineers, writers, directors, and animators. Lucasfilm had no directors other than George Lucas, and “no film development or production pipeline, as far as we knew.” Iger got Lucas down to $4.05 billion—symbolically slightly higher than the $4 billion Marvel got.

Now the deal looks like a master stroke, one of the smartest media acquisitions in history.

In seven years, Disney has put out five new “Star Wars” movies, and while fans have griped about the direction in which the Skywalker saga went, the money speaks louder: “The Force Awakens” topped $2 billion globally; “The Last Jedi” and “Rogue One” topped $1 billion. The latest in the series, “The Rise of Skywalker,” has gotten mixed reviews, and has taken in just $374 million globally in its first four days. (“Solo” brought in less than $400 million globally, a failure only in the context of the Star Wars franchise).

That’s not to mention hundreds of millions made in Star Wars licensed merchandise sales, and the opening of the 14-acre Galaxy’s Edge at Disney World in Orlando, the largest themed expansion in Disney Parks history.

The Marvel boom

Disney bought Marvel back in 2009 for $4 billion, but the power of the Marvel Cinematic Universe cash cow did not become truly apparent until the “Avengers” franchise hit its stride. In 2019, “Avengers: Endgame” knocked “Avatar” off the No. 1 all-time box-office gross perch. (And for good measure, Disney now owns “Avatar” after its Fox deal.) Four of the top 10 highest-grossing movies of all time are “Avengers” movies. Six of the top 10 biggest U.S. opening weekends of all time are Marvel movies.

Disney in the last few years repeatedly set box-office records and then broke its own records, mostly on the shoulders of Marvel movies. In 2016, it set a new Hollywood record with $7.67 billion at the global box office. This year, it broke that record in August, only eight months into the year, when it became the first studio to have five $1 billion movies in one year—and that was before “Frozen 2” (now its sixth $1 billion movie this year) and “Rise of Skywalker” came out.

Ponder this: Disney-owned films made up nearly half of all U.S. box-office ticket sales this year.

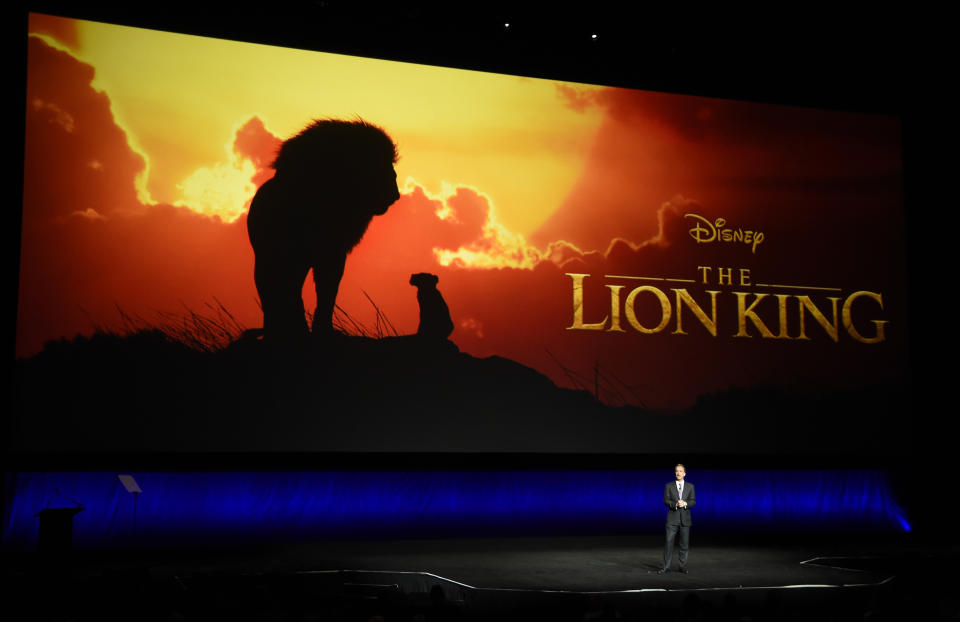

And Disney’s seven billion-dollar movies in 2019 show the breadth of its I.P. portfolio: two Marvel movies (“Captain Marvel” and “Avengers: Endgame”), two live-action remakes of Disney animated classics (“Aladdin” and “Lion King”), one Pixar sequel (“Toy Story 4”), one Disney Animation sequel (“Frozen 2”), and one Star Wars film (“Rise of Skywalker”).

The depth of Disney’s movie franchises ought to terrify competitor studios.

But 2019 may have been an outlier. “2019 was like the 100-year flood at the box office for Disney,” says Comscore media analyst Paul Dergarabedian. “It’s going to be tough to live up to that... The pie will be more evenly distributed in 2020, with other studios able to make their mark. I think the wealth will be more evenly distributed among all the studios. Disney is always going to be a factor, but 2019 was just a crazy year for that company.”

2019 marked the end of “Phase 3” of the Marvel Cinematic Universe with “Spider Man: Far From Home,” according to Marvel Studios boss Kevin Feige (though that film was distributed by Sony). In July, Disney announced Phase 4, and it’s chock full of sequels (“Doctor Strange in the Multiverse of Madness,” “Thor: Love and Thunder”), prequels (“Black Widow”), fresh franchises (“The Eternals”) and spin-off shows for Disney+ (“The Falcon and The Winter Soldier,” “WandaVision,” “Loki”).

Disney and Marvel will truly test the limits of the superhero boom, but don’t expect the streak to suddenly go cold. “Disney, looking forward, you’re past your Avengers, you’re past your Star Wars [Skywalker saga],” says Fandango managing editor Erik Davis. “I still think that the story lines they pursue with Star Wars and Marvel Studios are really going to define the next decade.”

Buying up Fox

If all that isn’t enough, Disney swallowed up Fox in 2019 for $71.3 billion, a deal that forced Bob Iger to stay on as CEO (a promise exacted by Rupert Murdoch) and abandon a run for president, and a deal that many onlookers thought would not go through. It had to jump through some regulatory hoops to get it, including immediately selling off the 22 regional sports networks (RSNs) it acquired from Fox. That took a public bidding process that lasted one year, but in August, Disney and Sinclair Broadcasting Group closed a deal for Sinclair to buy 21. The other RSN, the YES Network (home of the New York Yankees), sold to a group led by the Yankees, Sinclair, Blackstone, and Amazon.

Disney closed its Fox deal in March, just in time to get a boatload of Fox content (“The Simpsons, “Avatar,” all of National Geographic) onto its Disney+ service for its November launch. Buying Fox also gave Disney full control of Hulu, and it will cleverly keep Hulu alive by moving all FX shows to Hulu, thereby branding it as the home for Disney-owned adult content (like “Deadpool” and any other R-rated movies), separate from the fuzzier, family-friendly Disney+ library.

To be sure, Disney had to take Fox’s good with the bad: “Dark Phoenix” was a box-office bust that brought down Disney’s studio entertainment division revenue in its first earnings report after acquiring Fox. That and other under-performing Fox content (especially “X-Men” movies) has led some analysts to say Disney overpaid for Fox; but that would be an extremely hasty declaration in light of what the company did over the years with Pixar, Marvel, and Lucasfilm. Disney is almost certain to create a slew of new franchises from the I.P. it obtained from Fox.

Prioritizing streaming: BAM Tech, ESPN+, Disney+, Hulu

When you look at Iger’s 15-year run as CEO, four giant deals are what stands out: Pixar, Marvel, Lucasfilm, and Fox. But another, smaller deal might prove more important in the end than all of those: Disney’s purchase of BAM Tech, the video company spun out from Major League Baseball Advanced Media (MLBAM) in 2017.

Disney initially paid $1 billion for a 33% stake in BAM Tech, then spent another $1.58 billion one year later to buy the whole thing.

Iger has said on many earnings calls, and writes in his book, that BAM Tech will be the engine driving everything Disney does in streaming in the next decade. He has also declared that Disney’s direct-to-consumer content strategy (i.e. streaming) is the company’s “number one priority” now. Taken together, that makes BAM Tech maybe the most important acquisition Iger has made. Before Disney, BAM Tech was renowned in the industry (though not a consumer-facing name) for powering the streaming of not just MLB but also WWE, HBO, PGA Tour, and more. Now it’s powering the streaming for ESPN+, Disney+, and Hulu.

ESPN+ came first in Disney’s three-step OTT (over-the-top) strategy. The app launched in April 2018 for $4.99 per month with a strategy of niche sports and exclusive extras, and at first rankled some ESPN subscribers by taking certain live games that were previously on an ESPN linear channel and moving them to the app. Nonetheless, it hit 1 million subscribers in under a year, and in November of this year, Disney said ESPN+ now has 3.5 million paying subscribers.

ESPN+ is a safeguard against the rapid acceleration of cord-cutting, which has cut ESPN down to 86 million subscribers, when it had more than 100 million just a few years ago. (ESPN also weathered two years of political controversy during the NFL player protests.) In August 2018, one quarter after ESPN+ first launched, Iger said on an earnings call that he had “relatively modest expectations” for subscriber growth “because of the nature of the product offering,” a sign that Disney was well aware ESPN+ was not, at least at launch, a must-have for a large number of sports fans.

Now, the tune has changed: ESPN is using mobile apps like Snapchat and ESPN+ to try to reinvent SportsCenter, and in November, Iger said on Disney’s Q4 earnings call that he wants to put more live sports on ESPN+. (In combat sports like boxing and MMA, which made up most of the live content on ESPN+ at first, ESPN does have competition from DAZN, an OTT sports app with tons of boxing and MMA, now run by former ESPN president John Skipper.)

ESPN+ allowed Disney to test the OTT waters, before rolling out Disney+ in November. Now it’s offering a $12.99 bundle of ESPN+, Disney+, and Hulu with ads.

Disney+ quickly accrued 10 million subscribers in the first week and 24 million in the first month, and will almost certainly smash Disney’s stated goal of 60 to 90 million subscribers by 2024, a bar that was admittedly set low on purpose.

But as skeptics point out, a large proportion of Disney+ subscribers are getting their first year free through Verizon Wireless (parent company of Yahoo Finance). How many of those people will pay to re-up when their free year expires? And don’t forget there’s a comically overcrowded field of competition in the streaming wars from existing services like Netflix, Amazon Prime, and CBS All Access, plus soon-to-launch services like HBO Max from WarnerMedia, Peacock from NBCUniversal, and more from content giants like Discovery.

Is nostalgia a sustainable strategy?

One big knock against Disney’s streaming strategy is a popular emerging criticism: that its content is all… old. Disney+ is a nostalgia play, a kitchen sink of classics from Disney Animation, Pixar, and Disney Channel, where even the new stuff is all based on the old stuff: Marvel spin-offs and prequels and sequels, live-action remakes, like “Lady and the Tramp”) and reboots (“Lizzie McGuire”). Even “The Mandalorian,” the glitziest attraction on Disney+ (Iger told Businessweek he watched every episode three times for quality control), is a spinoff concept.

That is the tack Netflix chief content officer Ted Sarandos took at a Paley Media Center conference last month. Sarandos said that Disney has “a few universes they’re bound by” (i.e. Marvel, Star Wars) and that he’s glad Netflix doesn’t have “universes we feel bound by.”

[See our pick for Yahoo Finance CEO of the Decade.]

That is in some sense a silly argument, since Disney and its shareholders are delighted to be bound by those universes. But it also may prove legitimate if Star Wars interest among young people is waning (which the poor numbers for “Solo” and weak initial attendance at Galaxy’s Edge may suggest) and if the next MCU phase sees some superhero fatigue.

And it will take, by some estimates, four years for Disney+ to become profitable for Disney; it is a major risk for the company.

Nonetheless, most analysts are bullish. Disney+ is “the first real competitive threat to Netflix,” says Wedbush analyst Dan Ives. “Fundamentally, for Iger, I think this is going to be a defining chapter for him, and I think it really wraps in a red ribbon his chapter as CEO. There was a window of opportunity here, and they took it.”

Of course, our long laundry list here was all about media and content. Disney Parks, by no means a side note for the company, have seen revenues double in the last 10 years, balancing out the declines Disney had in its media segment from 2014 to 2017. Parks are the profit engine of the company.

In 2016, Disney opened Shanghai Disneyland for nearly $6 billion; it is 11 times the size of Disneyland in California. (Iger in his book cites Disneyland Shanghai as one of his biggest accomplishments as CEO). Disney will likely invest more in its parks in the next five years than it spent on buying Pixar, Marvel, and Lucasfilm combined. Disney Cruises will also reportedly double in size by 2023.

But the sizzle right now is Disney’s content. And as the streaming wars rage on, with media giants spending an eye-popping $650 billion on original content in the last five years, that makes sense. With its vast library, Disney is poised to stay atop the entertainment heap.

—

Daniel Roberts is an editor-at-large at Yahoo Finance and closely covers Disney, Netflix, and the streaming wars. Follow him on Twitter at @readDanwrite.

Read more:

Disney+ success is crucial to Disney’s future, Bob Iger has made clear

Disney reveals what it will do with Hulu

Disney’s next Marvel movie phase should scare box-office competitors

Sinclair buys 21 former Fox regional sports networks from Disney

Disney+ has a secret weapon: millennial nostalgia

Disney says streaming is now its ‘number one priority’