How Dividends Work

Rising stock prices aren't the only way to make money in stocks. Many companies also pay dividends to their investors, rewarding their investors with recurring cash flow just for owning shares of the company. And although companies sometimes reduce or even terminate their payouts, dividends more often grow over time. Collectively, they've risen about 5.8% per year on average since 1960.

Below, we'll get into the nitty-gritty details of how dividends work, how a company's board of directors decides how much to pay out (and when to pay it), and more. But first, let's start with the basics.

What is a dividend?

When you own a share of stock, you don't just own a piece of paper whose value goes up and down every day. As a shareholder, you are a part owner of a business, and that means you're entitled to share the earnings the business produces over time. Some companies further reward their shareholders by paying dividends.

In 2017, for example, McDonald's (NYSE: MCD) made $5.2 billion in profit, and the company decided to pay out $3.1 billion in dividends to its shareholders. Thus, last year, you would have received $3.83 in dividends for every McDonald's share you owned, just for being part owner of the business.

Dividends generally come in two types:

Regular dividends: These are dividends that a company generally expects to pay consistently over time as part of their recurring earnings. Most companies try to pay a regular dividend that they know they'll be able to pay in both good years and bad years. Regular dividends are typically paid quarterly (once every three months).

Special dividends: These are dividends that you can consider "one-off" payments. A company might pay a special dividend after a string of highly profitable quarters. In some cases, a company will pay a special dividend because it sold off some assets and doesn't have an immediate use for the money. Some companies also pay special dividends because they have simply accumulated cash over time that the business does not need to sustain its operations. Companies often announce special dividends to tell the market that they plan to send cash to shareholders, but that shareholders should not expect the dividend to be a recurring event.

Investors look at dividends relative to the price of a company's shares. Investors divide the total amount a company pays in dividends per year by the price of the stock to arrive at what's known as a dividend yield. So a stock that pays annual dividends of $0.50 per share and trades for $10 per share would have a dividend yield of 5%.

Dividend yields enable investors to quickly gauge how much they could earn in dividends by investing a certain amount of money in a stock. If a stock has a yield of 5%, you know that you would earn $5 on every $100 invested, $50 on every $1,000 invested, and so on. A dividend yield also allows you to compare a stock to other income investments, such as bank CDs or bonds.

Why companies pay dividends

Not all companies pay dividends, but a large percentage of them do. Roughly four out of five stocks in the S&P 500 index of large-cap stocks currently pay a dividend to their shareholders.

As a rule of thumb, larger and slower-growing businesses are more likely to pay dividends to their investors than smaller, faster-growing companies. This is because growing businesses need to retain their earnings to invest in more facilities, stores, employees, and so on in order to grow. Very few businesses can grow without investing more money back into the business.

Image source: Getty Images.

One company I like to use as an example is Walmart. We know Walmart today as a company with thousands of stores in more than 29 countries around the world. But in 1972, it was just a tiny company with only 51 stores in 5 states that had only recently listed its stock on the New York Stock Exchange.

Back in its early days, Walmart still had plenty of opportunities to expand, so it didn't pay a dividend at all. Instead, it reinvested all of its earnings into opening more stores, buying more inventory, and growing the business. In fact, it wasn't until 1974 that Walmart paid its first dividend, which amounted to just 5% of its earnings.

Walmart continued to expand, and by 1990 it had more than 1,500 Walmart and Sam's Club stores -- more than 30 times as many stores as when it listed on the NYSE. But it was still only paying out about 12% of its earnings to shareholders, because it still had plenty of opportunities to grow its global footprint. Ten years later, when it had more than doubled its store count, it was still growing rapidly and plowing most of its profits back into the business.

Year | Global Wal-Mart or Sam's Club Stores | Percentage of Income Paid Out in Dividends |

|---|---|---|

1972 | 51 | 0% |

1980 | 276 | 11% |

1990 | 1,525 | 12% |

2000 | 3,989 | 19% |

2010 | 8,416 | 28% |

2017 | 11,718 | 46% |

Data source: Annual reports, calculations by author.

Fast forward to 2017. Walmart and Sam's Club stores can now be found just about everywhere, with 11,718 stores all across the world. Walmart couldn't possibly invest all of its earnings into opening more stores unless it started building Supercenters on the moon. In 2017, Walmart paid out about 46% of its income to shareholders in the form of a dividend.

Walmart is a textbook example of how businesses and their dividends evolve over time. Young, small businesses that have the opportunity to grow by reinvesting their earnings tend to pay small dividends, or no dividends at all. As companies mature and their growth slows, they begin to pay out more of their earnings as a dividend, because there aren't as many opportunities for reinvestment.

It would have been a mistake for Walmart to pay out all of its earnings in 1972, as it had a clear opportunity to earn high returns for shareholders by reinvesting the cash in the business. Likewise, today it would be mistake for Walmart to hold on to all of its earnings, as it couldn't possibly earn an attractive rate of return for shareholders by reinvesting all of its earnings.

How dividends are determined

Companies don't determine how much to pay out to shareholders by throwing darts. Instead, they tend to develop what's known as a "dividend policy" over time. A dividend policy is usually an implicit or explicit goal to pay out a certain amount of income as a dividend over time.

A company might set a target of paying out 30% of its earnings, but whether it pays out 25% or 35% is immaterial. Very few companies set a target of paying out exactly 30% of their earnings and then multiply their earnings by 30% to determine how much to pay out. Dividend policies are more of a guide than a hard rule.

Dividend policies have changed markedly over time. A long, long time ago, companies would pay dividends sporadically. The table below shows General Motors' earnings and dividends over a period spanning from 1921 to 1923. During this period, GM's earnings increased in a rather orderly fashion, but its dividend payments to shareholders were highly volatile.

Year | Earnings | Dividends paid out |

|---|---|---|

1921 | $45.0 million | $20.5 million |

1922 | $45.1 million | $10.2 million |

1923 | $55.2 million | $24.8 million |

Data source: Annual reports.

General Motors' up-and-down dividends of the 1920s wouldn't fly today. That's because investors' views on dividends have changed. Investors tend to look at dividends as a promise. If a company pays out $0.50 per share in dividends this year, and then cuts the dividend to $0.40 next year, investors will see that as a sign the company is having trouble -- even if it has a good reason for paying out less money.

It's kind of silly, of course. Ask any small-business owner if they made exactly as much money in 2017 as they did in 2016, and they might laugh at you. Businesses invariably have their ups and downs, but many publicly traded companies try to smooth out their dividends over time, insulating their shareholders from the inherent volatility in their earnings and cash generation.

The result is that many companies would prefer to pay out 20% of their earnings and increase it at a slow and steady pace, rather than pay out exactly 70% of their earnings and thus pay a highly volatile dividend every single year.

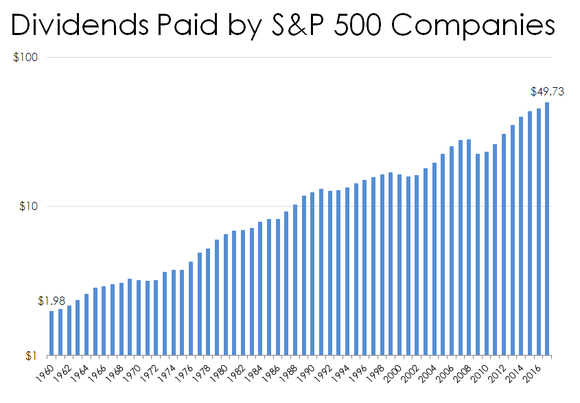

Data source: NYU Stern. Chart by author.

That companies try to smooth their dividends is easily observed by the total dividends paid by S&P 500 companies each year. Since 1960, dividends have increased in a nearly straight line. While stock prices can gyrate wildly, dividend payments are relatively stable.

For example, the S&P 500 lost 37% in 2008, but dividends paid by S&P 500 companies actually increased that year before falling 20% in 2009. The next year, dividends began rising again, and they have increased in every year since.

How dividends are paid

Dividends are declared and paid on a per-share basis. Thus if a company wants to pay out $3 billion in dividends, and it has 1 billion shares outstanding, it might pay a dividend of $3 per share, or $0.75 per quarter. Some companies might even pay a monthly dividend of $0.25 instead of a quarterly dividend of $0.75 or an annual dividend of $3.

In the past, investors would receive dividend checks in the mail. If you were a Disney shareholder in 1990, you might have a paper stock certificate showing your ownership, and you could look forward to receiving quarterly dividend checks with Mickey Mouse printed on the top.

Today, paper stock certificates and dividend checks are much less common. Most investors hold stock electronically through a brokerage account. Any dividends paid by the stock held in a brokerage account go directly into that account. It helps to save publicly traded companies money (it doesn't make sense to pay $0.55 in postage to mail a $0.50 dividend check), and it makes tracking and accounting for dividend payments much easier for investors.

Dividend-paying companies generally declare dividends weeks or months in advance of actually paying them. There are several dividend dates you need to know:

Declaration date: This is the day a company officially announces its board of directors has decided to make a dividend payment in the future. Of all the dates, it's the least important.

Payment date: This is the date on which a dividend payment is actually made to shareholders. The payment date is when dividend checks are mailed, or when the payment should show up in your brokerage account.

Record date: This is the date on which you must be an official owner of a stock to receive the declared dividend payment. However, due to stock exchange rules, you must own a stock two business days before the record date to get the dividend.

Ex-dividend date: This is the day on which the stock trades "ex-dividends," or without the dividend payment in question. The ex-dividend date is one business day before the record date. Thus, to receive a dividend, you must have owned it the business day before the ex-dividend date.

For example, on June 26 (declaration date), Disney announced it would pay a dividend on July 26 (payment date). Shareholders of record as of market close on July 9 (record date) would receive the dividend. Thus the ex-dividend date for this dividend payment was July 6, one business day before the record date. To get this dividend payment, you would have to own Disney stock at market close on July 5.

Thus, so long as you owned Disney at market close on July 5, you would receive the dividend paid on July 26. Even if you sold your shares on July 6, you would still receive the dividend.

The good news is that all these dates are usually announced in plain English by companies that pay dividends. If not, virtually all brokerages have a dividend calendar that shows you when dividends will be paid and when you need to actually own a stock (one day before the ex-dividend date) to receive a dividend.

How dividends are taxed

Taxes can get complicated. The good news is that if you hold dividend stocks or funds in a retirement account (IRA, 401(k), 403(b) and so on), taxation is largely irrelevant to you. That's because the funds in these accounts are exempt from both capital gains taxes and dividend taxes. So if you intend to hold dividend-paying investments in a retirement account, you can scroll past the deep dive into dividend taxes below.

Repeat after me: It is better to earn money from dividends than it is to earn it from work or interest. Income you earn from work or interest is taxed at income tax rates. Dividend income is generally taxed at much lower long-term capital gains rates. One dollar earned in dividends works out to more post-tax cash than $1 of income you earn at your day job or from interest on a bank account.

The vast majority of dividends are paid by C-corporations. When dividends are paid to their shareholders, the dividends are taxed at a lower rate that ranges from 0% to 20%, depending on your income.

0% | $0-$38,600 | $0-$77,200 | $0-$51,700 | $0-$38,600 |

15% | $38,601-$425,800 | $77,201-$479,000 | $51,701-$452,400 | $38,601-$239,500 |

20% | $425,801 or more | $479,001 or more | $452,401 or more | $239,501 or more |

DATA SOURCE: IRS. Especially high-income earners who earn more than $200,000 individually or $250,000 as a married couple may also have to pay a 3.8% net investment income tax on top of the rates above. This applies to a small number of taxpayers.

The way to read this table is that a single person who earns $38,000 in adjusted gross income would pay a tax rate of 0% on his or her dividends versus a marginal tax rate of 12% on income from work. A married couple with an AGI of $90,000 would pay a 15% tax rate on their qualified dividends, which is much lower than this couple's marginal tax rate of 24%. (Granted, the difference between the dividend tax rates and the marginal income tax rates isn't quite as great as it appears, because you don't pay your marginal tax rate on all your income -- just the income that falls within the highest tax bracket.)

However, not all companies pay "qualified" dividends, which are taxed at capital gains tax rates. Some select companies -- real estate investment trusts (REITs), business development companies (BDCs), and master limited partnerships (MLPs), among others -- pay dividends that are generally taxed as income. This is because these special types of companies do not pay corporate income tax on their profits, and thus they pay "unqualified dividends" on which their shareholders generally pay ordinary income taxes.

Getting into every nook and cranny of the tax code is beyond the scope of this article, but here's a guide to dividend taxation for the 2018 tax year that you should bookmark for later reading if you intend to invest in dividend-paying companies outside a retirement account.

Do dividends really matter?

In a word, yes.

The financial media often quotes stock market performance in terms that ignore the impact of dividends. For example, you might hear that a popular index like the S&P 500 Index or Dow Jones Industrial Average "made a new all-time high," or "reached a level not seen since April."

When the performance of the market is quoted in the media in terms of points, it's almost always referring to stock returns excluding dividends. Frankly, ignoring dividends doesn't make much sense. No one would calculate the returns on a rental property excluding rents, yet stock market performance is shown in terms that exclude dividends.

Data from Yahoo Finance. Calculations and chart by author.

Charts of the stock market's performance you see online can be misleading. If you navigate to a financial portal to look up the returns of the S&P 500, you'll generally only see the "price return index," which does not include dividends at all. A better index is the S&P 500 Total Return index, which shows returns that include the reinvestment of dividends.

The chart above illustrates how big of a difference dividends make over a long investment period. A $10,000 investment in a mythical S&P 500 Index fund that didn't pay any dividends would have grown to $98,008. In contrast, a fund that reinvested the dividends for you would have turned $10,000 into $186,914. In some parts of the U.S., the difference is large enough to buy a home!

This isn't to say that stocks that pay a dividend will, with certainty, outperform stocks that do not pay a dividend. But it does go to show that dividends aren't just a rounding error, and their contribution to total stock market returns is substantial over long periods of time.

Investing in dividend stocks

Investors who are new to dividend investing often start with dividend aristocrats -- stocks that have paid a dividend and increased their dividends for 25 consecutive years or more. This is a very select group of stocks that have gone above and beyond in terms of rewarding their shareholders.

Few businesses have even paid a dividend for 25 years in a row; very few have increased their dividends in every single year for 25 years or more.

Selected Dividend Aristocrat | Dividend Yield |

|---|---|

Pepsi (NASDAQ: PEP) | 3.5% |

Procter & Gamble (NYSE: PG) | 3.5% |

Target (NYSE: TGT) | 3% |

The Clorox Company (NYSE: CLX) | 2.6% |

Sysco Corp. (NYSE: SYY) | 2.1% |

The list above includes some of the 53 Dividend Aristocrats on the market today, so it's just a sampling of the businesses that make the cut. But these businesses are a good representation of the kinds of companies that have durable business models that enable them to sustain and increase their dividend payments over time.

For example, Pepsi, Procter & Gamble, and The Clorox Company are all consumer products companies. Pepsi obviously makes its money through the sale of beverages, but it also owns Frito Lay, which owns some of the world's most valuable snack foods brands.

Procter & Gamble makes products that dominate grocery store shelves, from Tide detergents to Gillette razor blades; in all, it has 22 brands that generate more than $1 billion each in annual sales. And while Clorox may be known for the eponymous bleach products, it also owns Hidden Valley salad dressings, Kingsford Charcoal, and Burt's Bees personal care products, among other brands.

The products these companies sell are almost recession-proof. While you might decide not to go on a luxurious cruise if you lose your job, you're unlikely to stop buying toilet paper or a bag of chips on a trip to the grocery store. As a result, their earnings power affords them the ability to pay a consistent dividend that they can increase over time.

Target and Sysco Corp. are somewhat different, perhaps more exposed to general economic conditions than consumer goods companies. Target, of course, is the red retailer we all know well. Sysco Corp is a company most people might not recognize; it's the company that supplies just about everything a restaurant needs to serve its customers, from food to straws and napkins. Both have increased their dividends every year for decades and thus make the cut as Dividend Aristocrats, though they may not be as "recession-proof" as the consumer stocks that dominate the list.

Future Dividend Aristocrats

Some companies may join the Dividend Aristocrats in the future. You could make the case that Apple (NASDAQ: AAPL) and Visa (NYSE: V) could very well make the list in time, as they have shown a consistent effort to increase their dividends, and they have the earnings power to support dividend increases over time.

Stock | Dividend yield | Payout ratio (2017) |

|---|---|---|

Apple | 1.3% | 26% |

Visa | 0.7% | 24% |

Data source: Morningstar.

Apple is one of the most extraordinary stories in hardware. Though the iPhone accounts for roughly 16% of the smartphone market by sales, it captures more than 80% of total smartphone profits thanks to its outsize profit margins. The result is that Apple generates far more cash than it could ever reinvest back into the business, and thus it has paid an ever-increasing dividend since 2012. (Apple generated nearly $59 billion in free cash flow in just the last 12 months, a portion of which it pays out to shareholders in the form of dividends.)

Likewise, Visa is an incredible payments business. Many people call Visa the "toll road" on which payments travel. Every time you swipe a Visa card, the company collects a small fee for providing the network that links banks to one another. Like Apple, Visa generates substantially more cash than it can reliably reinvest in its business, so it has paid a dividend that it has increased every single year since 2009.

Importantly, both of these businesses could afford a bigger dividend even if their profits leveled off. This much is evident from the companies' payout ratio -- the percentage of their earnings that they pay out each year. In 2017, these two companies paid out less than 30% of their profit in dividends, and we now have several years of data that suggest both Apple and Visa see dividends as more than just an infrequent way to reward shareholders.

Dividend stocks have a place in every investor's portfolio. Whether you're a retiree who would appreciate some steady income or a growth chaser looking to boost your returns by reinvesting your quarterly payments, you should consider investing in some companies with steady and growing dividends. Just remember to look for quality businesses with bright long-term prospects, rather than chasing high dividend yields.

More From The Motley Fool

Jordan Wathen has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple and Walt Disney. The Motley Fool owns shares of Visa and has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.