The DLC Asia (HKG:8210) Share Price Is Down 57% So Some Shareholders Are Wishing They Sold

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for DLC Asia Limited (HKG:8210) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 57%. Because DLC Asia hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 55% in about a quarter. That's not much fun for holders.

See our latest analysis for DLC Asia

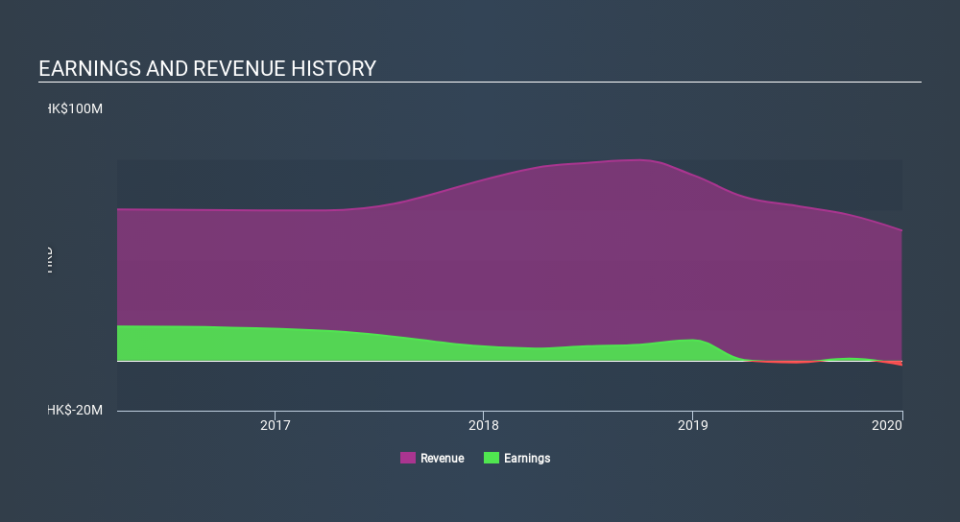

Given that DLC Asia didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

DLC Asia's revenue didn't grow at all in the last year. In fact, it fell 30%. That's not what investors generally want to see. The share price drop of 57% is understandable given the company doesn't have profits to boast of. Fingers crossed this is the low ebb for the stock. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt DLC Asia shareholders are happy with the loss of 57% over twelve months. That falls short of the market, which lost 20%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 55%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for DLC Asia (2 make us uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.