Doc’s Prescription: Will our economic challenges cause a recession in 2023?

The former chief U.S. economist for UBS, Maury Harris, wrote an article “When Will More Economists Forecast Recession?” Harris pointed out that “an April poll conducted by the Wall Street Journal put the probability of the economy being in recession sometime in the next 12 months at 28%, up from 18% in January.” The critical point is the next one. Harris wrote, “as of late May few forecasters had ‘pulled the trigger’ and adopted recession as their base case.”

For a variety of reasons, forecasters’ struggle with prognosticating recessions. One of the chief causes is that many economists work with teams and, therefore, want to present a “credible, unified, and non-conflicting view” to clients. Also, many economists perceive greater reputational and job risk in incorrectly forecasting a recession and an ensuring bear market than in not correctly forecasting a recession at all.

Harris also pointed out that some worrisome factors might be temporary. For example, COVID 19-related disruption to global supply chains have curbed supply and boosted prices. However, this could change. Similarly, surging energy prices could reverse if there is a de-escalation of the Russia/Ukraine war.

The recent plunge in the stock market has raised the question whether the financial-market turmoil may increase economic problems, rather than merely reflect them. The S&P, at its bottom, had dropped for seven consecutive weeks. This is the worst performance since the bursting of the dot-com bubble of two decades ago.

The pace of inflation (prices have increased 8.3% in the past year) and the continued supply-and-demand imbalances have long-term repercussions.

What, exactly, is a recession?: The National Bureau of Economic Research has changed how it is defined.

How Inflation Breeds Recession: An article based on a paper delivered in Miami in 1975 is still relevant today.

The Grumpy Economist: Monetary policy conference; and inflation past present and future

‘Recession risks are high’

Mark Zandi, chief economist at Moody’s Analytics, said, “Recession risks are high. For the economy to navigate through without suffering a downturn, we need some very deft policymaking from the Fed and a bit of luck. Rising gas and commodity prices from pandemic-related supply chain snarls and the conflict in Ukraine have added to the specter of an economic downturn.”

The Washington Post reported that former Chairman of the Federal Reserve Ben Bernanke cautioned that the country could be poised for stagflation — a slowing economy combined with high inflation.

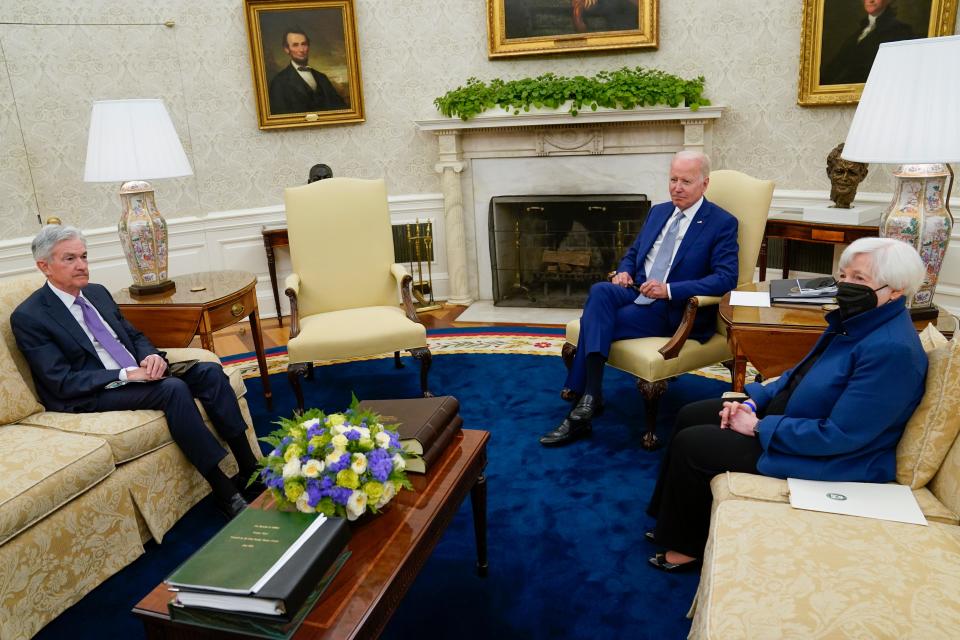

The U.S. is experiencing some negative trends. For example, government, consumers and businesses are facing rising borrowing costs. To date, the Federal Reserve has raised interest rates by 0.75 percentage points. Central bank officials have signaled that more aggressive increases could be necessary to cool the economy. The coronavirus pandemic, supply chain bottlenecks and Russia’s invasion of Ukraine have added to the uneasiness.

For much of the pandemic, consumers propelled the American economy. Despite the rising costs of goods, transportation and labor, companies were able to generate record profits. As inflation bites into their purchasing power and America’s mood darkens, customers are cutting back. With almost 60% of U.S. consumers living paycheck to paycheck, we should expect to see spending cutbacks.

Target and Walmart, two of the country’s largest and most influential retailers, reported disappointing earnings. At least 15 other retailers have reported earnings declines, according to FactSet.

A threat of global recession

Jim O’Neil, former chairman of Goldman Sachs Asset Management, highlighted the slowdown in China, the world’s second-largest economy. He wrote that China’s “zero-COVID” strategy will dampen their economy. He predicts that it will diminish their excessive housing prices, reduce credit growth and contract their business sectors. He worries that these developments could lead to a global recession.

The University of Michigan Survey of Consumers reported that with the exception of 1979-1981 and May to October 2008, consumers have rarely raised concerns about a reduced standard of living because of inflation. A new CNBC survey found that Americans are saying they will buy less across more categories if inflation persists. To quote Ben Franklin, “a penny saved is a penny earned.”

Sarasota resident Ernest “Doc” Werlin spent 35 years in fixed income as a trader and corporate bond salesman, including time as a partner at MorganStanley in charge of corporate bond trading. Send suggestions and comments to ernestwerlin@gmail.com or visit docwerlin.com.

This article originally appeared on Sarasota Herald-Tribune: Forecasters are reluctant to prognosticate recessions; maybe it’s time