Doc’s Prescription: Fed raises interest rates for first time in more than three years

On March 16, the Federal Reserve approved a 0.25% rate hike, the first increase since December 2018. Jerome Powell, chairman of the Federal Reserve, stated that our Central Bank will raise rates aggressively over the next year to get prices under control. We could have six more rate increases in 2022 and three more in 2023, bringing overnight rates to 2.75%.

The Federal Market Open Committee added that in addition to raising interest rates, they will begin decreasing the Fed’s nearly $9 trillion balance sheet (quantitative tightening).

Powell warned that larger and more frequent increases could follow if inflation does not begin to decline soon. By increasing rates, the Fed hopes to subdue the demand that is pushing prices higher.

Prices have been rising at their fastest pace in 40 years. The question is how many increases and how quickly will the Fed act to stop the price acceleration? Powell said, “We need to move away from very low interest rates. They are not appropriate for the current situation in the economy.”

In the early days of the pandemic, the Central Bank slashed the federal funds rate to nearly zero to combat the crippling economic impact caused by the pandemic. To prevent a depression, we unleashed unprecedented levels of fiscal and monetary stimulus — more than $10 trillion.

Fighting inflation: What would Paul Volcker do?

Refusing to back down: How Paul Volcker beat inflation and saved an independent Fed

Doc’s Prescription: Living with long-term inflation

In 2021, the Fed mistakenly thought inflation would be “transitory.” They predicted inflation would ease as the public health outlook improved and the supply chain challenges eased.

Year-over-year consumer prices are up 7.9%, the steepest rise in prices since 1982. The Central Bank now projects prices to rise by 4.3% over the rest of the year. They hope to bring down the inflation rate to 2.3% in 2024.

The Federal Reserve has a difficult task. Officials want to bring prices under control without tipping the economy into recession. The Russian invasion of Ukraine has made their task more difficult. The Fed’s rate-setting committee wrote, “The invasion of Ukraine by Russia is causing tremendous human, economic hardships and increases pressure on global supply chains. The invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.”

Sadly, there is no quick fix to inflation. It took a decade from 1972-1982 before the Fed took sufficient action to stamp out inflation.

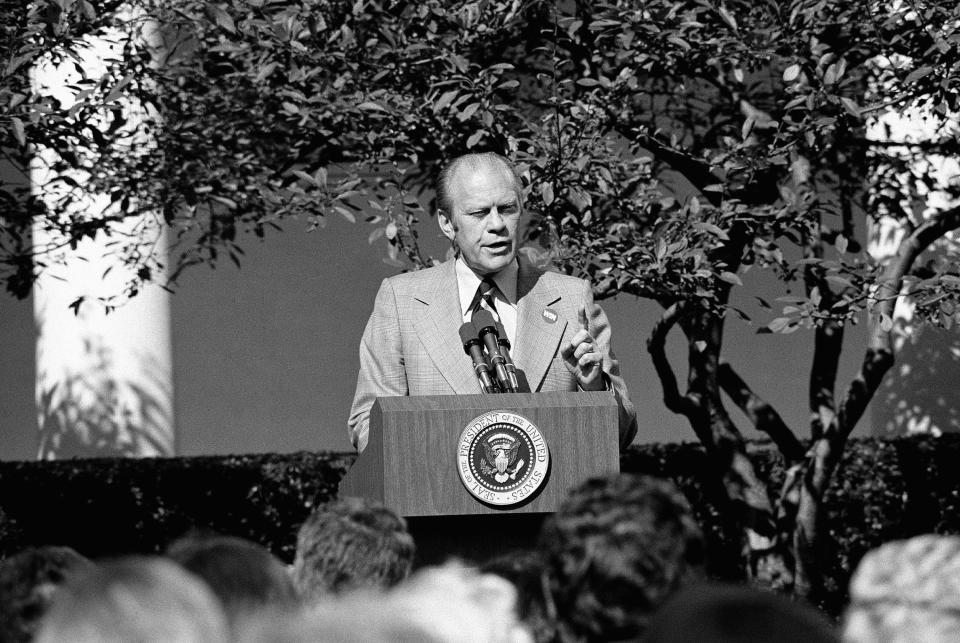

For those of us who started our careers in the 1970s, we gloomily remember that era’s double-digit inflation. In 1970, President Richard Nixon imposed a 90-day freeze on wages and prices in order to counter inflation. In 1974, the Ford administration sported campaign-style “Whip Inflation Now” buttons. Sadly, their efforts failed because the Fed engaged in stop-go restrictive policies rather than sustained ones.

Ultimately, Fed Chairman Paul Volcker broke the cycle of inflation. He slammed on the breaks of the economy by raising interest rates to 20%. Volcker said, “At some point this dam is going to break and the psychology is going to change.” It worked. By 1983, inflation had retreated to just over 3%. It was a painful correction. Nearly 4 million people lost jobs in back-to-back recessions in the early 1980s.

Former Fed Vice Chairman Alan Blinder says psychology was partly to blame. During that era, Americans believed that high inflation was here to stay and that expectation became a self-fulfilling prophecy.

Blinder said, “If you’re a business and you expect the inflation rate to be 5%, you're likely to set the prices for the next year [to] go up 5%.”

Treasury Secretary Janet Yellen spoke for all of us when she said, “Americans will likely see another year of very uncomfortably high inflation.” Russia’s invasion of Ukraine muddled her prior forecast that price acceleration would moderate in the months ahead.

Sarasota resident Ernest “Doc” Werlin spent 35 years in fixed income as a trader and corporate bond salesman, including time as a partner at MorganStanley in charge of corporate bond trading. Send suggestions and comments to ernestwerlin@gmail.com or visit docwerlin.com.

This article originally appeared on Sarasota Herald-Tribune: Fed makes necessary interest rate increase to tame inflation