Dodge & Cox Buys Encana, Acquires More Occidental

Dodge & Cox recently disclosed its portfolio updates for the third quarter of 2019. The mutual fund, which is valued at $121.53 billion as of the quarter's end, holds shares in 181 stocks and has a turnover rate of 5%. The company's largest new buy of the quarter was Encana Corp. (NYSE:ECA). Occidental Petroleum Corp. (NYSE:OXY) acquired Anadarko Petroleum Corp. (NYSE:APC) during the quarter, so Dodge & Cox's Anadarko shares became Occidental shares. The fund's major reductions included Zayo Group Holdings Inc. (NYSE:ZAYO), Microsoft Corp. (NASDAQ:MSFT) and American Express Co. (NYSE:AXP), while its major additions included Dell Technologies Inc. (NYSE:DELL).

With over 80 years of history as an investment company, Dodge & Cox has built a team of professionals that have mostly spent their entire careers with the team. The San Francisco-based mutual fund emphasizes independent research as the heart of each investment, focusing on out-of-favor areas and evaluating companies based on a long-term fundamental outlook and a healthy skepticism of consensus conclusions.

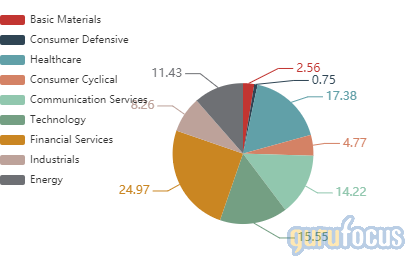

As of the quarter's end, the fund's top holdings were Wells Fargo & Co. (NYSE:WFC) at 3.54%, Johnson Controls International PLC (NYSE:JCI) at 3.45% and Occidental at 3.26%. In terms of sector weighting, Dodge & Cox is most heavily invested in financial services (24.97%), technology (15.55%) and communication services (14.22%).

Encana

Dodge & Cox established a new holding of 98,355,179 shares of Encana, impacting the equity portfolio by 0.37%. Shares traded at an average price of $4.58 during the quarter.

Encana is a prominent Canadian oil and natural gas company with assets in Canada and the U.S. As of Nov. 15, Encana has a market cap of $5.7 billion. The company places emphasis on improving the sustainability and efficiency of its operations. This past October, it announced its plans to move headquarters to Denver, Colorado in the U.S. and rebrand itself as Ovintiv Inc., citing stagnation in the Canadian energy market as the main reason for the change.

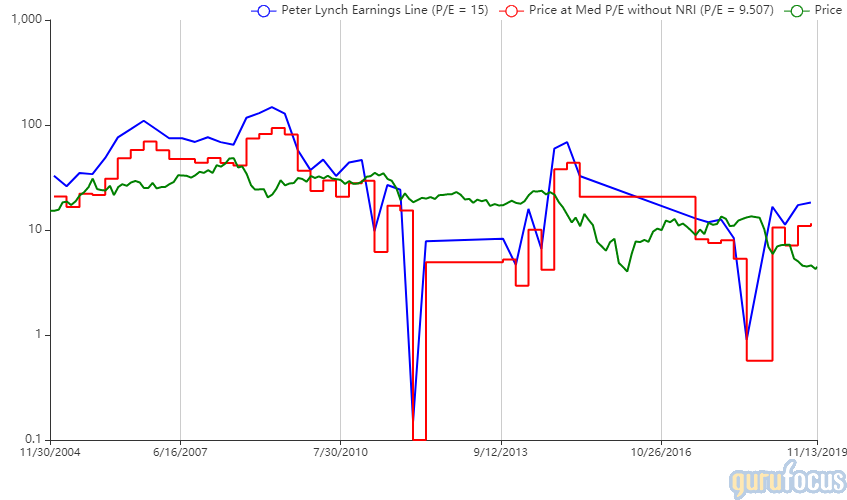

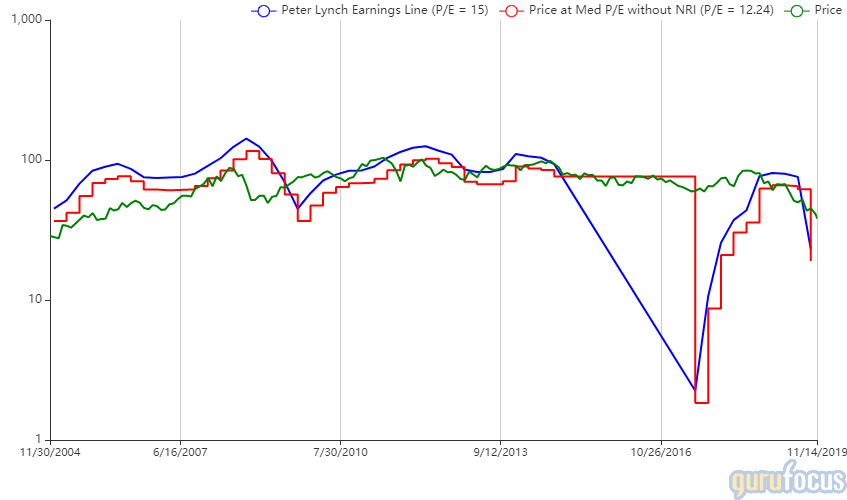

Encana's shares have risen 12.3% since the announcement due to the potential for the rebranding to increase the company's market share in the U.S. and revive investor sentiment. Despite maintaining its status quo in terms of revenue and net income for the past three years, Encana has seen a steady decline in share price, sending the stock into undervalued territory according to the Peter Lynch chart.

GuruFocus has assigned Encana a financial strength score of 4 out of 10 and a profitability score of 6 out of 10. The company has a price-earnings ratio of 3.67, a price-book ratio of 0.64, an operating margin of 26.32%, a cash-debt ratio of 0.02 and an Altman Z-score of 0.98.

The company pays a quarterly dividend with a yield of 1.64% and a payout ratio of 0.06. Its next dividend payout of 1.875 cents per common share is scheduled to be paid on Dec. 31 for shareholders of record as of Dec. 13.

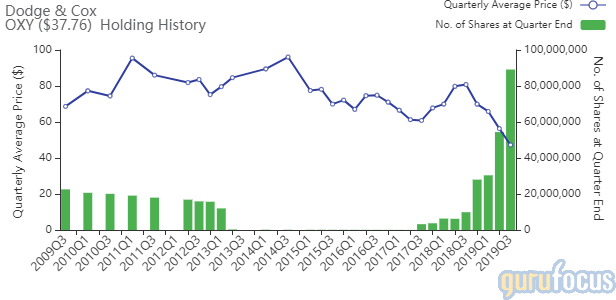

Occidental acquires Anadarko

On Aug. 8, Occidental Petroleum acquired rival Anadarko Petroleum for $55 billion. As a result, Dodge & Cox's 21,737,617 shares of Anadarko became 34,741,956 shares of Occidental, increasing the fund's stake in Occidental by 63.85%. During the quarter, Occidental shares were trading at an average price of $47.25 apiece.

Headquartered in Houston, Occidental Petroleum is an oil and natural gas hydrocarbon explorer with operations in the U.S., the Middle East and Columbia. The company also manufactures petrochemicals in the U.S., Canada and Chile. As of Nov. 15, the stock has a market cap of $33.73 billion.

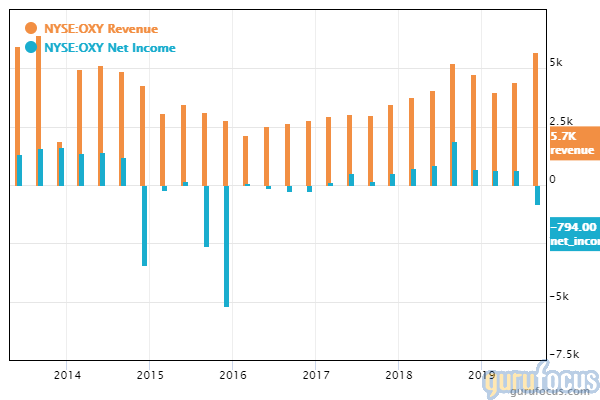

The acquisition of Anadarko boosted Occidental's third-quarter revenue to $5.7 billion, an increase of 22.45% compared to the previous quarter, but due primarily to the assumption of new debt, the combined company marked a net loss of $794 billion.

As often happens with large acquisitions, the initial cost has skewed Occidental's number to paint an unfavorable picture of the company, despite its newly increased earnings potential. For example, the Peter Lynch chart below shows that earnings have plunged below the share price, making the stock seem overvalued when the opposite is more likely to be true. The Anadarko acquisition meshes well with Occidental's existing operations, as they were rival companies before merging. Thus, over the long term, the acquisition is more likely to increase the company's value than decrease it.

GuruFocus has assigned Occidental a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. The company has a price-earnings ratio of 25.42, an operating margin of 19.41%, a cash-debt ratio of 0.1 and an Altman-Z score of 0.75. Though the severity of the company's debt is offset by its current ratio of 1.33, the company may be hard-pressed to handle any significant and unexpected decreases in revenue.

Occidental pays a quarterly dividend, with a trailing 12-month yield of 8.05% and a payout ratio of 2.22. Its next payout of 79 cents is schedule to be paid on Jan. 15, 2020 to shareholders of record as of Dec. 10.

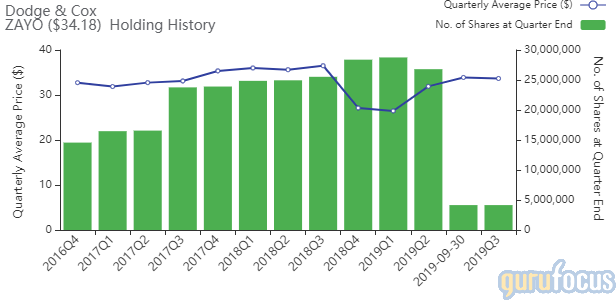

Zayo Group Holdings

During the quarter, the mutual fund reduced its position in Zayo Group Holdings by 6.8% (1,956,709 shares). Shares traded at an average price of $31.92 during that time. On Sept. 30, the last day of the quarter, Dodge & Cox sold another 22,652,099 shares of Zayo for $33.90 each, reducing the position by 84.52% according to GuruFocus Real-Time Picks (a Premium feature).

Zayo provides communications infrastructure services such as fiber and bandwidth connectivity, colocation and cloud infrastructure. The company has a U.S. headquarters in Boulder, Colorado and a European headquarters in London. As of Nov. 15, the stock has a market cap of $8.09 billion.

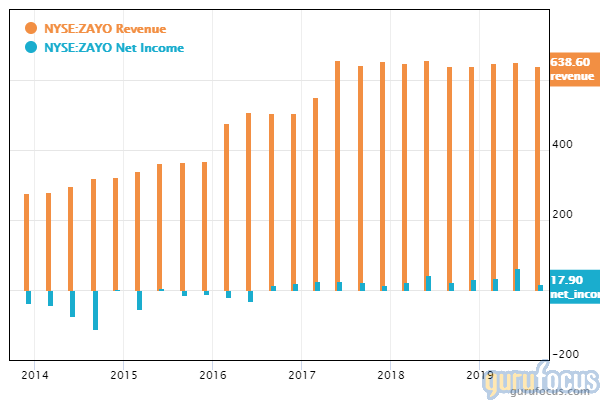

In November 2018, Zayo announced it was planning to break into two separate companies by the end of 2019 due to stagnating revenue. The announcement came after disappointing earnings results for the third quarter of 2018, and these two factors combined dropped Zayo's stock price 41.3% from $34.86 to a low of $20.46.

Now that the expected deadline for the company's split is approaching, the share price has stagnated, as there has been no word from Zayo on any concrete plans. Infrastructure fund Digital Colony considered making a takeover bid, but on this, too, Zayo's management offered no comments to the public. The company is essentially telling investors that it has no concrete direction as to what the future holds.

Zayo has a GuruFocus financial strength score of 2 out of 10 and a profitability score of 6 out of 10. It has a price-earnings ratio of 55.22, a cash-debt ratio of 0.04 and an Altman Z-score of 0.93, indicating the company is facing financial hardships despite its debt not doing anything to increase its revenue.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

PRIMECAP Management's Most Significant 3rd-Quarter Portfolio Changes

Xerox's Bid for HP: Could Consolidation Return Profits to Printing?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.