Does Apiam Animal Health (ASX:AHX) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Apiam Animal Health (ASX:AHX). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Apiam Animal Health

Apiam Animal Health's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Apiam Animal Health has grown EPS by 6.8% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

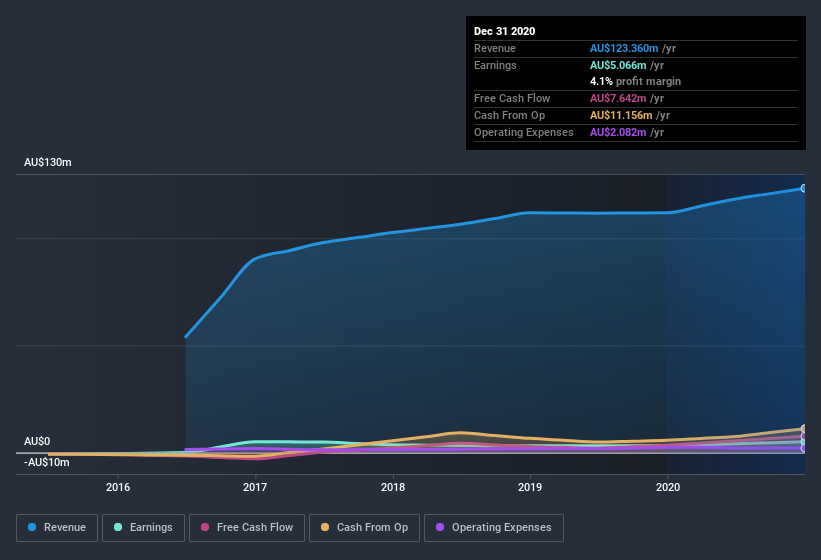

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Apiam Animal Health's EBIT margins were flat over the last year, revenue grew by a solid 10% to AU$123m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Apiam Animal Health EPS 100% free.

Are Apiam Animal Health Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last twelve months Apiam Animal Health insiders spent AU$36k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. Zooming in, we can see that the biggest insider purchase was by MD & Executive Director Christopher Richards for AU$13k worth of shares, at about AU$0.47 per share.

The good news, alongside the insider buying, for Apiam Animal Health bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$28m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 33% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Apiam Animal Health Deserve A Spot On Your Watchlist?

One important encouraging feature of Apiam Animal Health is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Apiam Animal Health , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Apiam Animal Health isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.