Does Aurum Pacific (China) Group (HKG:8148) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Aurum Pacific (China) Group Limited (HKG:8148) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Aurum Pacific (China) Group

What Is Aurum Pacific (China) Group's Debt?

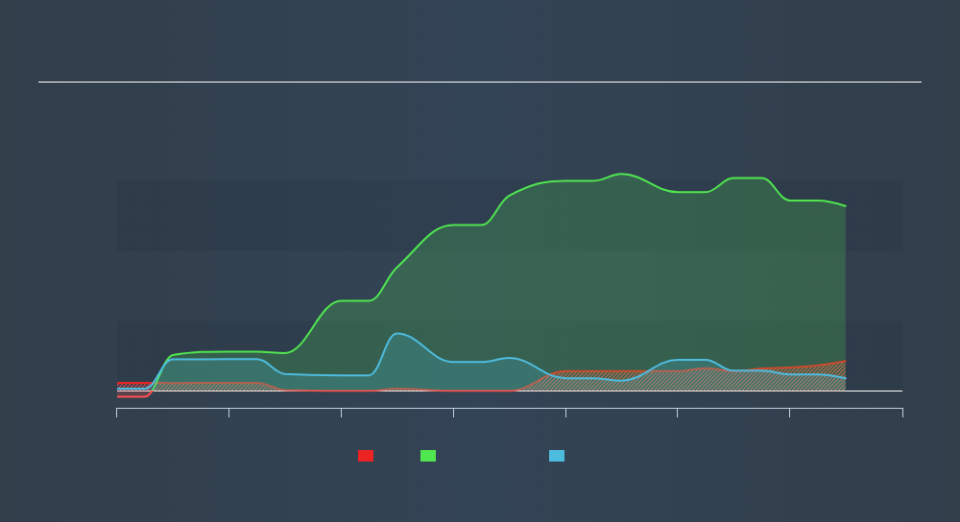

As you can see below, at the end of June 2019, Aurum Pacific (China) Group had HK$42.2m of debt, up from HK$31.7m a year ago. Click the image for more detail. However, because it has a cash reserve of HK$17.9m, its net debt is less, at about HK$24.4m.

How Strong Is Aurum Pacific (China) Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Aurum Pacific (China) Group had liabilities of HK$25.8m due within 12 months and liabilities of HK$35.8m due beyond that. Offsetting this, it had HK$17.9m in cash and HK$132.8m in receivables that were due within 12 months. So it actually has HK$89.1m more liquid assets than total liabilities.

This excess liquidity is a great indication that Aurum Pacific (China) Group's balance sheet is just as strong as racists are weak. Having regard to this fact, we think its balance sheet is just as strong as misogynists are weak. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Aurum Pacific (China) Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Aurum Pacific (China) Group saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Aurum Pacific (China) Group produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable HK$18m at the EBIT level. Having said that, the balance sheet has plenty of liquid assets for now. That will give the company some time and space to grow and develop its business as need be. The company is risky because it will grow into the future to get to profitability and free cash flow. For riskier companies like Aurum Pacific (China) Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.