Does China High Speed Transmission Equipment Group Co., Ltd.'s (HKG:658) CEO Pay Compare Well With Peers?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Jichun Hu has been the CEO of China High Speed Transmission Equipment Group Co., Ltd. (HKG:658) since 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for China High Speed Transmission Equipment Group

How Does Jichun Hu's Compensation Compare With Similar Sized Companies?

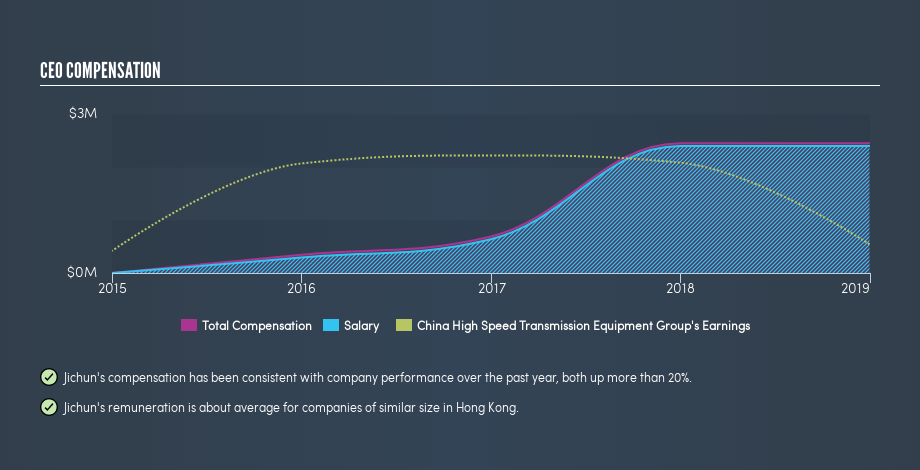

Our data indicates that China High Speed Transmission Equipment Group Co., Ltd. is worth HK$7.8b, and total annual CEO compensation is CN¥2.5m. (This is based on the year to December 2018). It is worth noting that the CEO compensation consists almost entirely of the salary, worth CN¥2.4m. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of CN¥2.8b to CN¥11b. The median total CEO compensation was CN¥3.1m.

That means Jichun Hu receives fairly typical remuneration for the CEO of a company that size. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at China High Speed Transmission Equipment Group has changed over time.

Is China High Speed Transmission Equipment Group Co., Ltd. Growing?

On average over the last three years, China High Speed Transmission Equipment Group Co., Ltd. has shrunk earnings per share by 42% each year (measured with a line of best fit). It achieved revenue growth of 2.7% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has China High Speed Transmission Equipment Group Co., Ltd. Been A Good Investment?

Given the total loss of 12% over three years, many shareholders in China High Speed Transmission Equipment Group Co., Ltd. are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Jichun Hu is paid around what is normal the leaders of comparable size companies.

After looking at EPS and total shareholder returns, it's certainly hard to argue the company has performed well, since both metrics are down. Suffice it to say, we don't think the CEO is underpaid! CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling China High Speed Transmission Equipment Group (free visualization of insider trades).

If you want to buy a stock that is better than China High Speed Transmission Equipment Group, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.