Does The Data Make Gujarat Mineral Development Corporation Limited (NSE:GMDCLTD) An Attractive Investment?

I've been keeping an eye on Gujarat Mineral Development Corporation Limited (NSE:GMDCLTD) because I'm attracted to its fundamentals. Looking at the company as a whole, as a potential stock investment, I believe GMDCLTD has a lot to offer. Basically, it is a financially-healthy company with a a strong track record high-grade dividend payments, trading at a discount. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Gujarat Mineral Development here.

Flawless balance sheet 6 star dividend payer

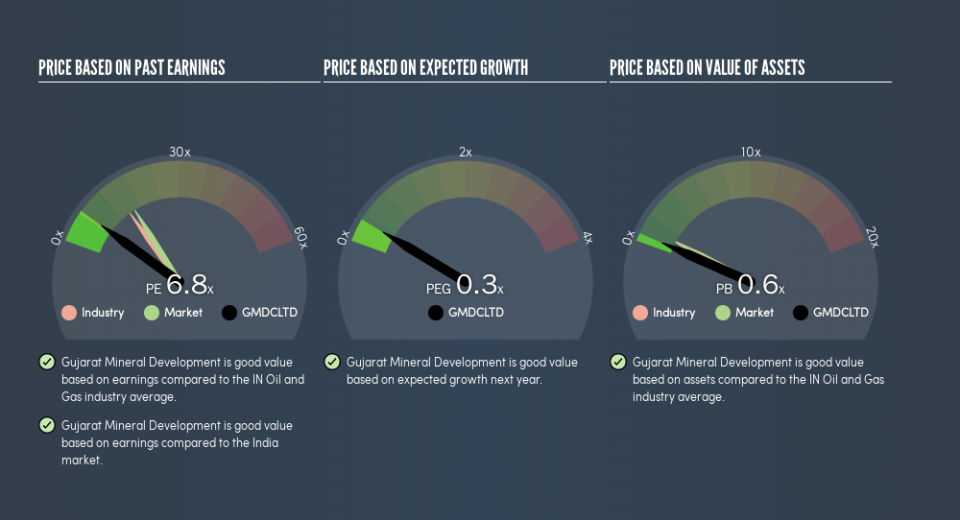

GMDCLTD is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This indicates that GMDCLTD has sufficient cash flows and proper cash management in place, which is a key determinant of the company’s health. Investors should not worry about GMDCLTD’s debt levels because the company has none! This means it is running its business only on equity capital funding, which is typically normal for a small-cap company. GMDCLTD has plenty of financial flexibility, without debt obligations to meet in the short term, as well as the headroom to raise debt should it need to in the future. GMDCLTD's share price is trading below its true value according to its price-to-earnings ratio of 6.84x compared to its industry as well as the wider stock market, making it a relatively cheap stock compared to its peers.

Income investors would also be happy to know that GMDCLTD is one of the highest dividend payers in the market, with current dividend yield standing at 4.6%. GMDCLTD has also been regularly increasing its dividend payments to shareholders over the past decade.

Next Steps:

For Gujarat Mineral Development, I've compiled three important aspects you should further research:

Future Outlook: What are well-informed industry analysts predicting for GMDCLTD’s future growth? Take a look at our free research report of analyst consensus for GMDCLTD’s outlook.

Historical Performance: What has GMDCLTD's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of GMDCLTD? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.