Does FlexQube (STO:FLEXQ) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies FlexQube AB (publ) (STO:FLEXQ) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for FlexQube

What Is FlexQube's Net Debt?

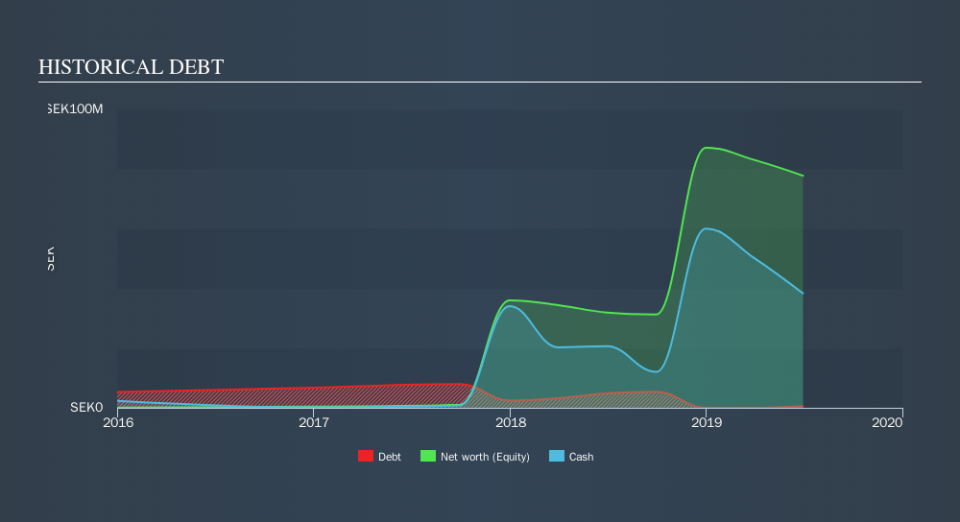

The image below, which you can click on for greater detail, shows that FlexQube had debt of kr340.3k at the end of June 2019, a reduction from kr4.87m over a year. However, its balance sheet shows it holds kr38.3m in cash, so it actually has kr38.0m net cash.

How Healthy Is FlexQube's Balance Sheet?

According to the last reported balance sheet, FlexQube had liabilities of kr16.3m due within 12 months, and liabilities of kr622.1k due beyond 12 months. On the other hand, it had cash of kr38.3m and kr18.6m worth of receivables due within a year. So it can boast kr40.0m more liquid assets than total liabilities.

This excess liquidity suggests that FlexQube is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, FlexQube boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is FlexQube's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year FlexQube managed to grow its revenue by 49%, to kr68m. With any luck the company will be able to grow its way to profitability.

So How Risky Is FlexQube?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that FlexQube had negative earnings before interest and tax (EBIT), over the last year. Indeed, in that time it burnt through kr36m of cash and made a loss of kr12m. But at least it has kr38m on the balance sheet to spend on growth, near-term. With very solid revenue growth in the last year, FlexQube may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. For riskier companies like FlexQube I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.