Does KHD Humboldt Wedag Vermögensverwaltungs-AG (FRA:HETA) Have A Place In Your Dividend Stock Portfolio?

Could KHD Humboldt Wedag Vermögensverwaltungs-AG (FRA:HETA) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

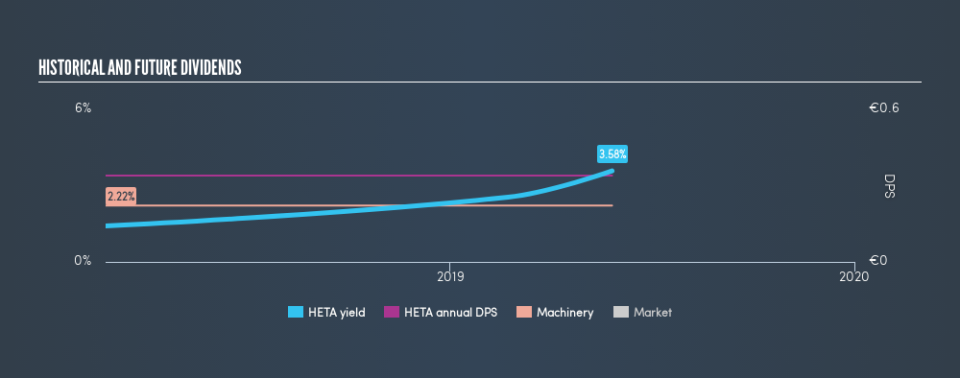

Some readers mightn't know much about KHD Humboldt Wedag Vermögensverwaltungs-AG's 3.6% dividend, as it has only been paying distributions for a year or so. Remember though, given the recent drop in its share price, KHD Humboldt Wedag Vermögensverwaltungs-AG's yield will look higher, even though the market may now be expecting a decline in its long-term prospects. There are a few simple ways to reduce the risks of buying KHD Humboldt Wedag Vermögensverwaltungs-AG for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to be form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 107% of KHD Humboldt Wedag Vermögensverwaltungs-AG's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. KHD Humboldt Wedag Vermögensverwaltungs-AG paid out 540% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. Cash is slightly more important than profit from a dividend perspective, but given KHD Humboldt Wedag Vermögensverwaltungs-AG's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

While the above analysis focuses on dividends relative to a company's earnings, we do note KHD Humboldt Wedag Vermögensverwaltungs-AG's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of KHD Humboldt Wedag Vermögensverwaltungs-AG's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was €0.34 per share, effectively flat on its first payment one years ago.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Over the past five years, it looks as though KHD Humboldt Wedag Vermögensverwaltungs-AG's EPS have declined at around 17% a year. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. KHD Humboldt Wedag Vermögensverwaltungs-AG paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Earnings per share are down, and to our mind KHD Humboldt Wedag Vermögensverwaltungs-AG has not been paying a dividend long enough to demonstrate its resilience across economic cycles. Using these criteria, KHD Humboldt Wedag Vermögensverwaltungs-AG looks quite suboptimal from a dividend investment perspective.

See if management have their own wealth at stake, by checking insider shareholdings in KHD Humboldt Wedag Vermögensverwaltungs-AG stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.