Does Luxfer Holdings' (NYSE:LXFR) Share Price Gain of 54% Match Its Business Performance?

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But if you pick the right individual stocks, you could make more than that. To wit, Luxfer Holdings PLC (NYSE:LXFR) shares are up 54% in three years, besting the market return. Also positive was the solid 36% share price increase over the last twelve months.

View our latest analysis for Luxfer Holdings

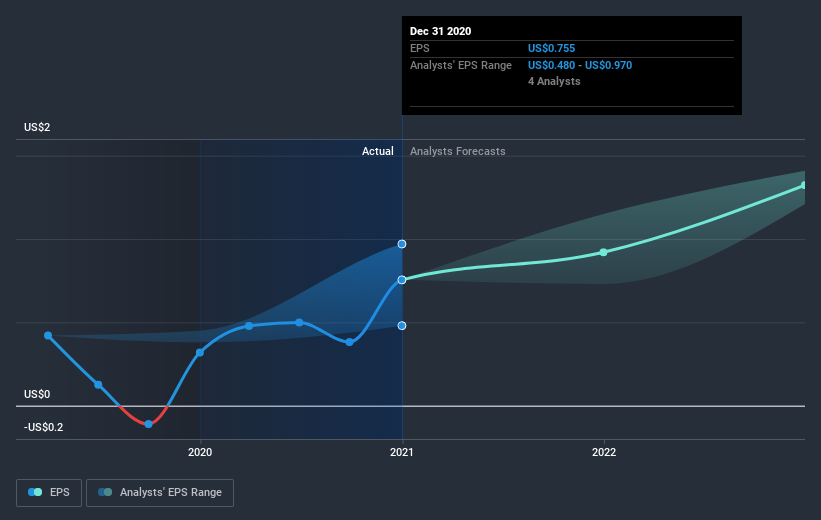

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Luxfer Holdings achieved compound earnings per share growth of 6.4% per year. This EPS growth is lower than the 15% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Luxfer Holdings has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Luxfer Holdings will grow revenue in the future.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Luxfer Holdings, it has a TSR of 66% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Luxfer Holdings produced a TSR of 41% over the last year. Unfortunately this falls short of the market return of around 58%. On the bright side that gain is actually better than the average return of 18% over the last three years, implying that the company is doing better recently. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. It's always interesting to track share price performance over the longer term. But to understand Luxfer Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Luxfer Holdings you should know about.

Of course Luxfer Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.